How to Value a Private Company

Read time: 3-4 minutes

“Strive not to be a success, but rather to be of value.” (Albert Einstein)

Introduction

As a business owner, you probably have a general sense for the range of value for your company based in formal or informal analysis. However, you never truly know what it’s worth until you see what a buyer is willing to put in writing. Therefore, it’s important to understand how investors are likely to approach the valuation exercise so that you can be grounded in reality and ask informed questions of suitors at the appropriate time. The following guide will walk you through the common valuation methods, some key financial information used as inputs to determine value, and some tips to increase your valuation.

Common Business Valuation Methods

A lot of terminology gets thrown around when people start talking about valuing private companies. However, at their core, regardless of what they are called, they are simply ways to put a present value on future cash flows. Here are some of the most common and practical approaches investors will take.

| Description of Each Valuation Method | |

|---|---|

1. Public Comps 1. Public Comps |

Within your industry, there are often comparable public companies whose business is similar to yours, though on a larger scale. These public peers, or “comps”, have valuations that are publicly available and can provide guidance around how your business will be valued. Most investors will look to EBITDA and/or Revenue multiples, though there are an array of other ratios that can be analyzed if so inclined. Please remember, though, that a public comp will often be valued at considerably more than a smaller, private peer due to the inherent value of larger scale and the ease with which you can buy and sell public shares. So, in order to determine the value of your smaller, private company, you will typically have to apply a discount to the public comps. |

2. Precedent Transactions 2. Precedent Transactions |

The specifics of private transactions in your industry can be hard to come by if they are not disclosed, but in many instances details around the purchase price and implied multiple of EBITDA find their way to the public domain. Further, various entities (e.g. investment banks) that focus on your industry will often publish industry reports that summarize information about comparable private transactions. These reports can give you a good idea what sort of multiple you might fetch for your business. |

3. Returns Modeling 3. Returns Modeling |

If you are speaking with a private equity fund or other “financial buyer”, it’s likely that they will do some returns modeling around various growth assumptions for your business. Typically, private equity funds are shooting to double or triple their money over their investment period, and this will impact what they can pay. The most common returns modeling is called an “LBO Model” which forecasts out 5 or so years of performance with certain assumptions regarding the amount and type of debt the buyer would intend to put on the business. |

4. Perception of Value 4. Perception of Value |

Experienced investors will often have an intuitive feel for a company’s worth if provided with sufficient information about historical / projected performance. It’s probably discounting the value of this intuition to call it “gut feel”, but veteran investors can often come extremely close to an accurate EBITDA multiple without traditional analysis. Whether they will admit it or not, many investors consult their intuition before other more analytical methodologies. |

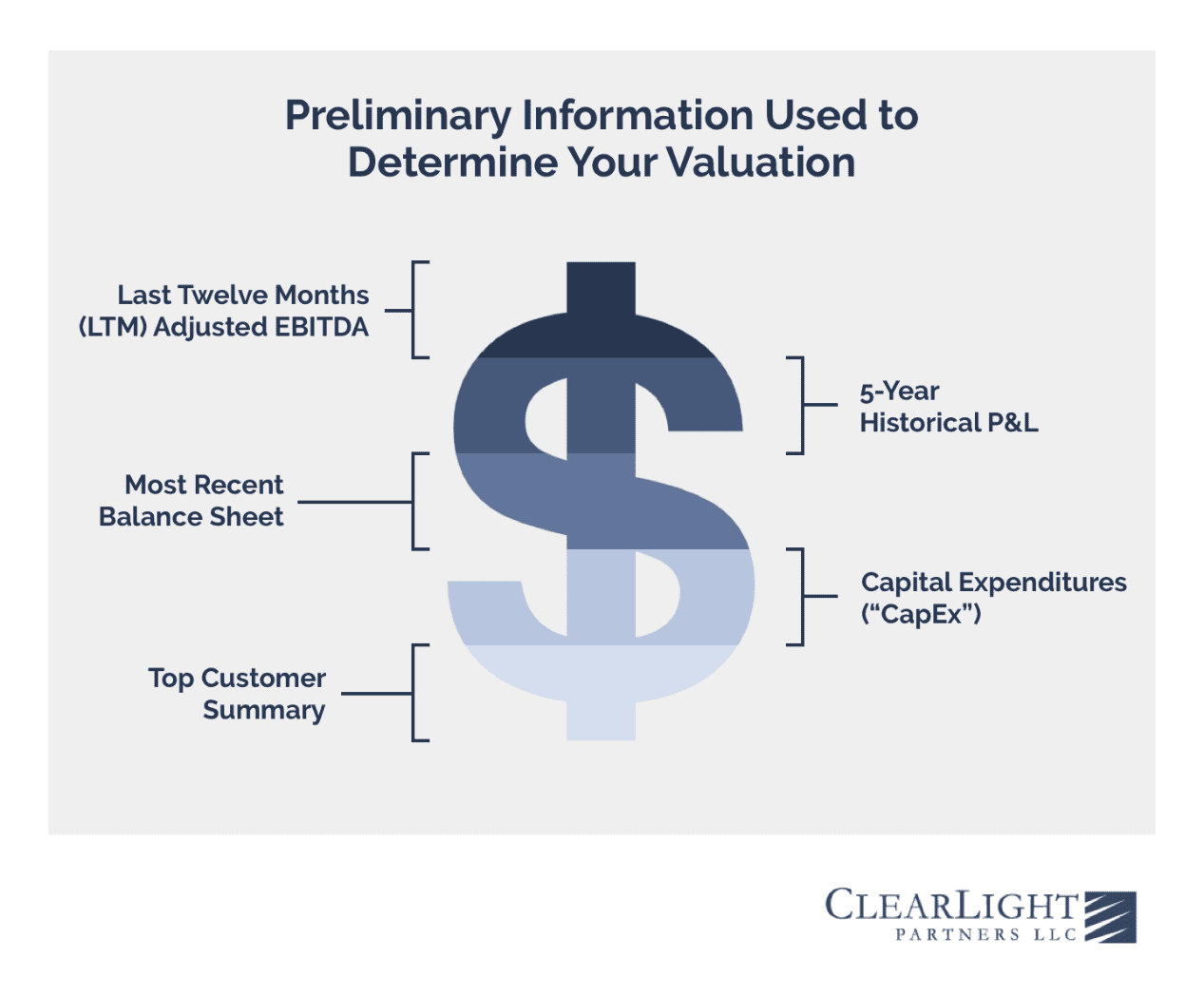

Key Financial Information Used to Value a Private Company

If you decide to sell your company, there’s no question that it will ultimately entail the provision of a large amount of data to a potential buyer. However, in the early stages of courtship, the items below are typically sufficient for an investor to arrive at a preliminary valuation range. If you decide to explore discussions with investors, you should make sure you at least have the following items readily available and well organized for when they ask:

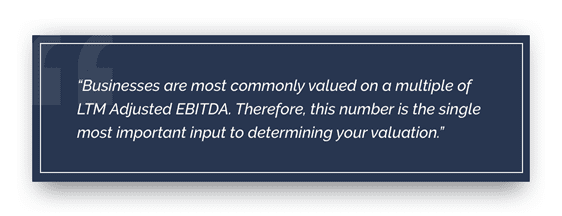

- Last Twelve Months (LTM) Adjusted EBITDA. Businesses are most commonly valued on a multiple of LTM Adjusted EBITDA. Therefore, this number is the single most important input to determining your valuation. Note that we’ve incorporated the term, “Adjusted” here. It’s important to present an EBITDA figure that reflects your company’s profitability if it were to be owned by another entity. In other words, if there are non-recurring or inflated expenses (e.g. Country club memberships, vehicles, etc.) that would not be incurred under new ownership, it is customary to add these expenses back to arrive at a normalized, or Adjusted EBITDA figure. Just don’t get too creative here lest you lose credibility with an investor.

- 5-Year Historical P&L. A 5-year snapshot of your income statement will give an investor a good idea of how Revenue, Gross Profit and EBITDA have been trending along with your various expense line items. This is important because if Revenue and profitability have been steadily increasing, that will give an investor comfort that your trajectory is relatively more likely to continue than if the alternative were true. These days, we sometimes even ask for a 10+ year history to see how a business performed during the Great Recession as a proxy for how it might weather a future downturn. A longer operating history becomes more important if a business or industry is inherently cyclical (e.g. Building products).

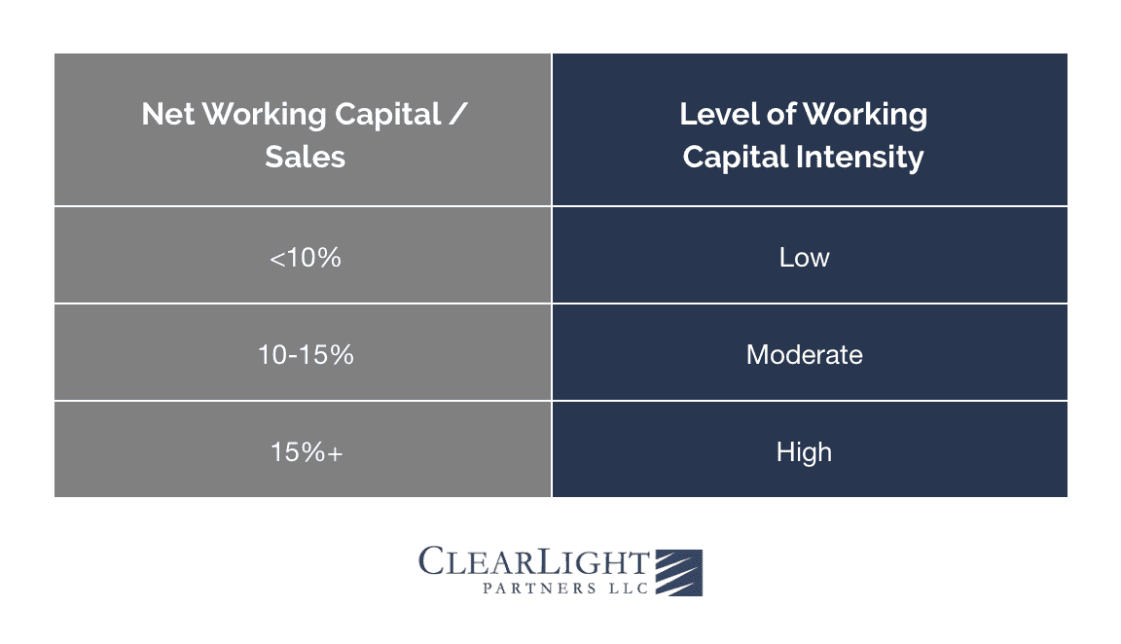

- Most Recent Balance Sheet. Balance sheets illuminate a few things of relevance to investors. One of the more important items is the degree to which your business consumes capital, or is “working capital intensive”. In other words, is a lot of cash trapped in receivables and inventory, or is the company efficient at converting P&L results into cash? This matters because as a business grows, a company that is more working capital intensive will consume more cash flow as it builds inventory, increases its receivables balance and funds various other asset line items. Here’s how most investors will assess your level of working capital intensity:

Net Working Capital = Current Assets (Excluding Cash) – Current Liabilities (Excluding Debt)

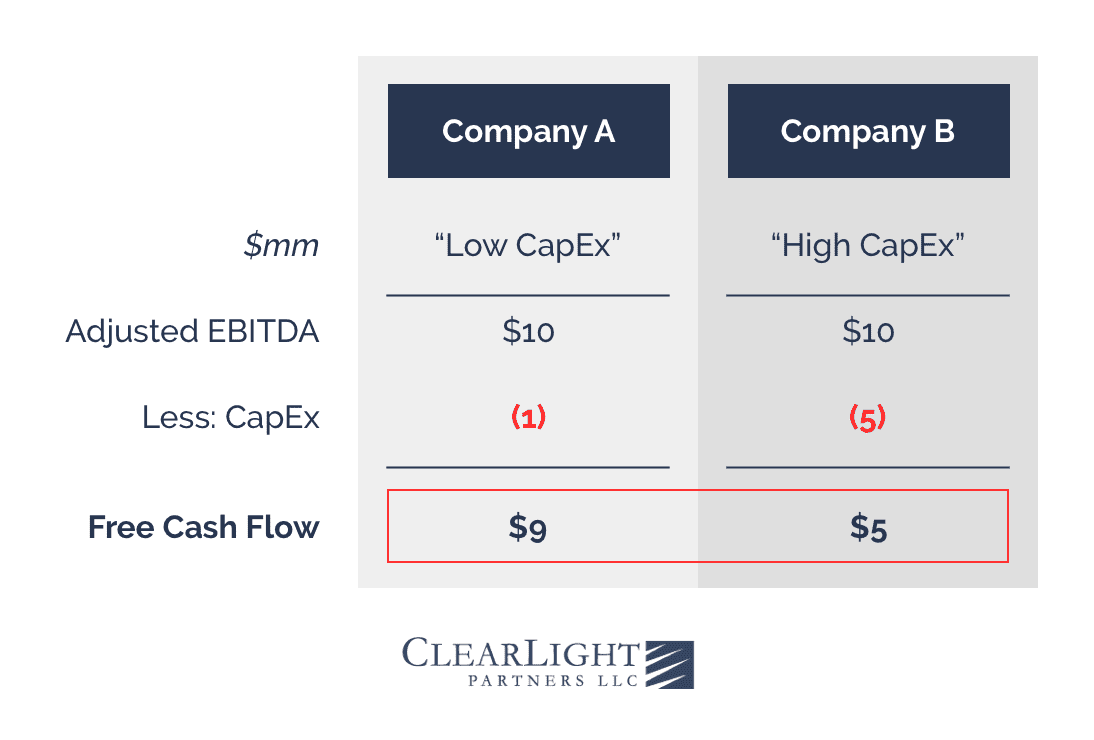

- Capital Expenditures (“CapEx”). Investors care about CapEx because it represents cash that has to be reinvested into a business to maintain and grow its profitability. Varying levels of CapEx across businesses and industries means that not all EBITDA is created equal. To that end, a common metric that buyers will evaluate is Adjusted EBITDA minus CapEx as an approximation for the true profitability of a business, or “free cash flow”. Take a look at the following example that highlights how CapEx can sway the amount of free cash flow a business is generating:

Free Cash Flow = Adjusted EBITDA – CapEx

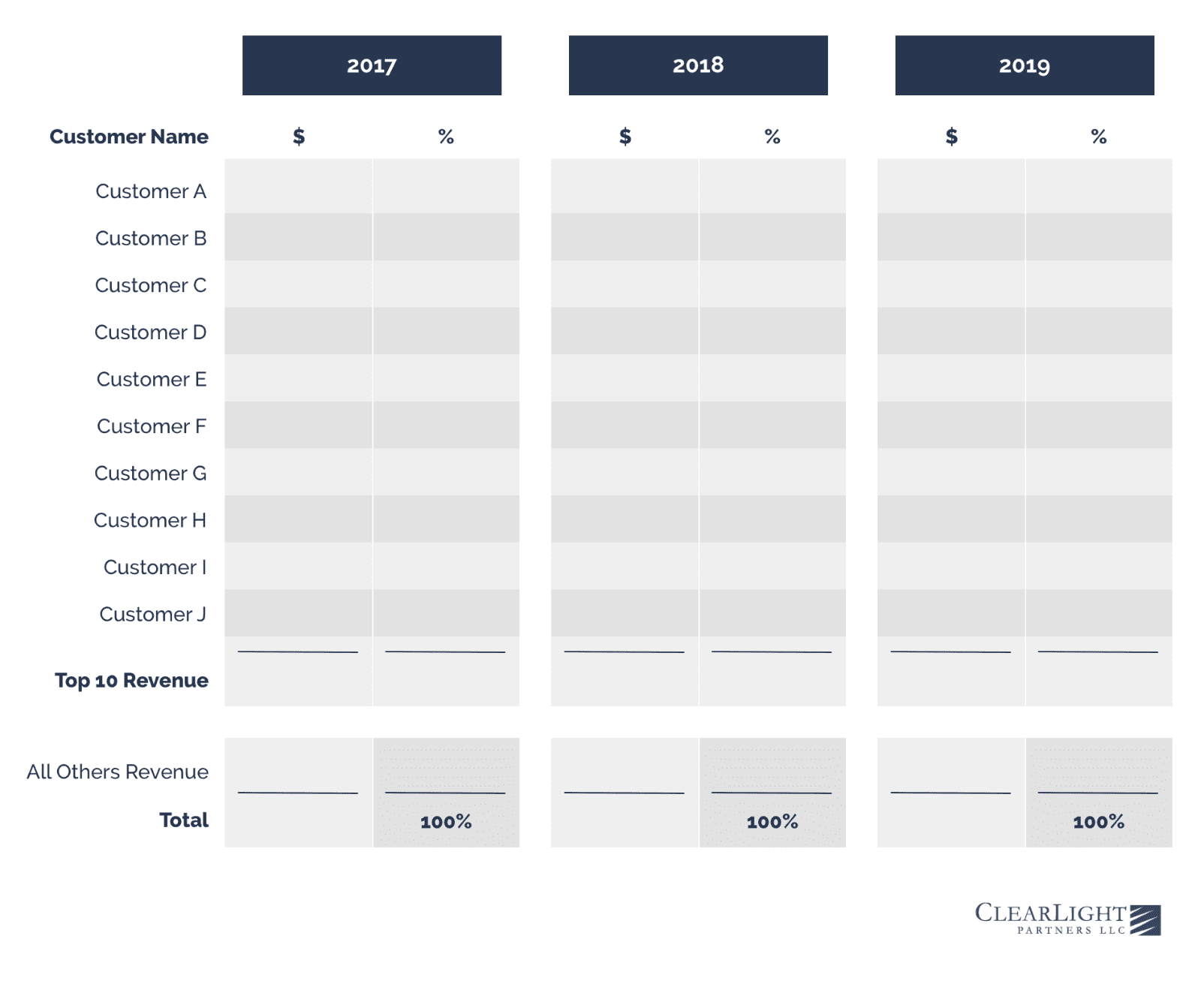

- Top Customer Summary. Most investors are allergic to customer concentration, so they’re going to want to know early in your discussions whether you have exposure to any single or small group of accounts. When requesting this item, investors will usually tell you that it’s OK to share your customer information on a no-names basis in recognition of its sensitivity. Ideally, you will have a few years of historical data regarding revenue by customer for each account to highlight any year-over-year variations in revenue, but a top 10 summary will usually suffice. Here’s an example of what such a summary may look like:

Tips to Increase Your Valuation

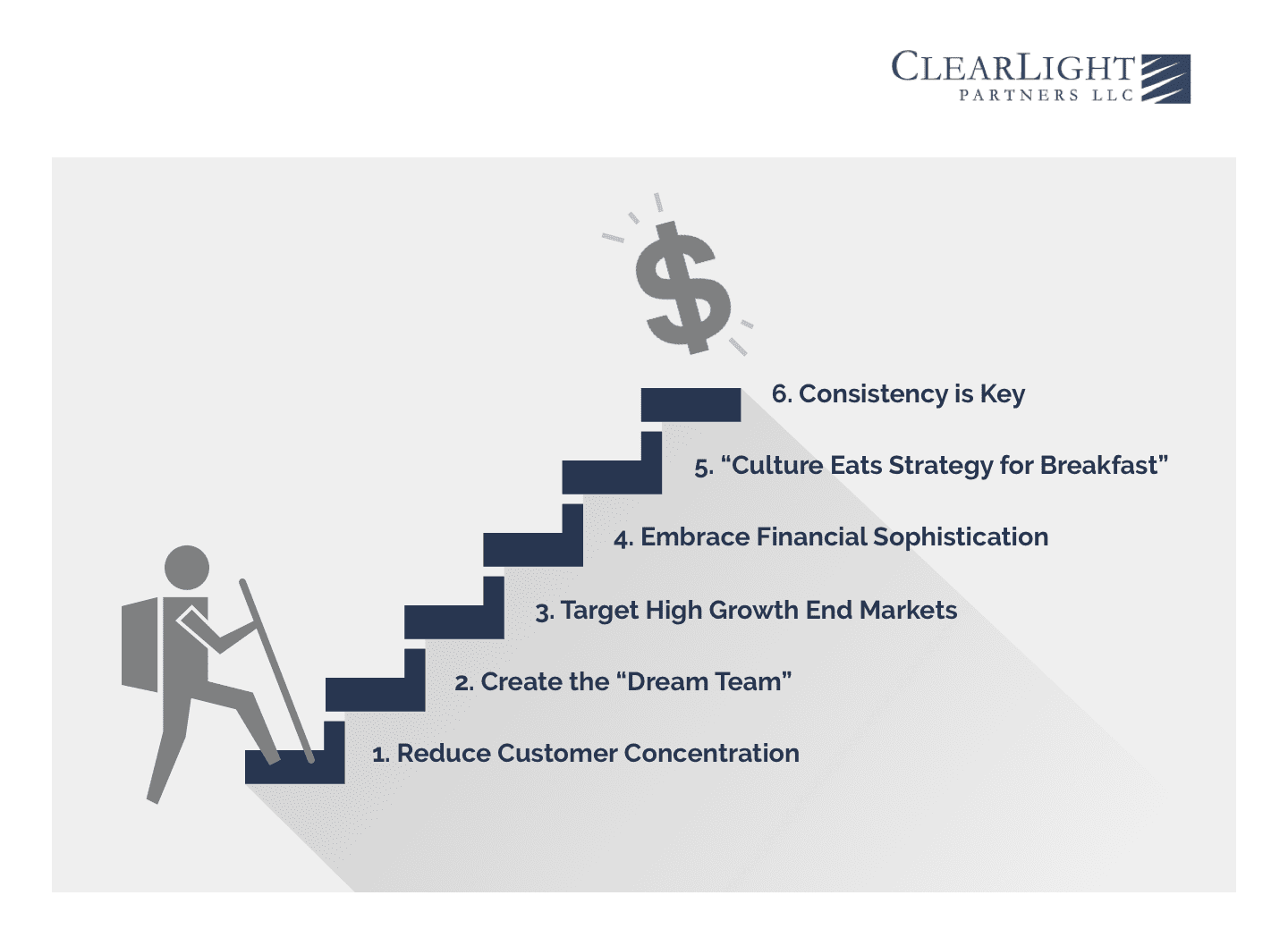

You’ve probably heard many of these before, but it never hurts to refamiliarize yourself with some essential business attributes that will attract investors and support a stronger valuation for your company. You can also download our guide to maximizing your exit valuation here.

- Reduce Customer Concentration. A dependence on large customers is a primary reason why an investor will pass or reduce valuation. Your goal should be to have your top customer generating less than 20% of total revenue. Above that level you will lose interest from a lot of suitors due to the risk of that customer going away. Many tenured investors have learned this lesson the hard way and are not likely to make the same mistake twice.

- Create the “Dream Team”. An overdependence on a company’s founder or CEO can scare investors that are leery of “key man risk”. A new investment partner will want to see that your company’s customer relationships have been institutionalized and that you have a talented supporting cast of executives ready to drive the business forward.

- Target High Growth End Markets. We’ve all heard that “a rising tide lifts all boats”, and most investors will agree that the tailwinds behind a good industry can be a powerful driver of good financial returns. So, if your product or service is supporting a sector with lackluster growth, it might be worth entering, or seeking help entering, some more attractive market segments.

- Embrace Financial Sophistication. This is where a talented CFO or operator can really move the needle. You cannot underestimate the value investors place on seeing accurate, timely and strategically insightful financial information. In general, financial reporting that reflects a professionally managed organization will help an investor get comfortable that you have a good grasp of the operations. Audited financials are another indicator the business has been managed to build long-term value. At a minimum, make sure any information provided to investors ties out across the various reports you send over.

- “Culture Eats Strategy for Breakfast”. A strong culture is palpable to an investor and is an important dimension in understanding a company’s prior successes and prospects for future growth. All else being equal, a passionate, energized team is always going to be more encouraging. Some easy indicators of this are demonstrated by Mission, Vision, Values driven organizations with leadership that walks the walk and employees that like coming into work every day.

- Consistency is Key. Historical ups and downs in revenue or profitability will make investors pause. If you can show sustained upward trajectory in both revenues and profit, then you are on your way to a better valuation. With that in mind, make sure to grow the right way with higher margin, recurring revenue when possible.

Conclusion

We hope you found this guide useful in gaining a better understanding for how professional investors will approach valuing your company. We’ve been investing in privately held companies for nearly 20 years now and would be happy to walk you through our proven process that has resulted in over 20 closed transactions with business owners. We’re here to help, so give us a call to start a conversation.

About ClearLight Partners

ClearLight is a private equity firm headquartered in Southern California that invests in established, profitable middle-market companies in a range of industry sectors. Investment candidates are typically generating between $4-15 million of EBITDA (or, Operating Profit) and are operating in industries with strong growth prospects. Since inception, ClearLight has raised $900 million in capital across three funds from a single limited partner. The ClearLight team has extensive operating and financial experience and a history of successfully partnering with owners and management teams to drive growth and create value. For more information, visit www.clearlightpartners.com.

Disclaimer: The views and opinions expressed in this blog are solely my own and do not necessarily reflect any ClearLight opinion, position, or policy.