Read time: 5-6 minutes

“Mediocre content will hurt your brand more than doing nothing at all.” (Joe Pulizzi)

Introduction

Content marketing is growing in importance for private equity. The logic goes something like this:

-

- There are a lot of private equity funds

- Demand for good deals exceeds supply

- Capital is perceived to be a commodity

- Therefore, if a fund wants to beat its competition, it needs to get better at marketing

Content marketing is defined as a type of marketing that involves the creation and sharing of online material that does not explicitly promote a brand but is intended to stimulate interest in its products or services. Said another way, content marketing is the misdirection of offering your target audience something of value so that your brand is consequently elevated. You might say that magicians discovered the power of sleight of hand, and marketers followed suit.

There’s some debate about the efficacy of content marketing, particularly within PE. This is probably due to the fact that even a well-executed strategy can take between 6-9 months to germinate thanks to algorithms that reward those that regularly produce reliable information. However, the data suggest that content marketing is indeed an effective way to drive lead volume. For example, companies with blogs get 67% more leads than those that don’t1. So, shouldn’t investors also incorporate blogging into their lead generation tool kit, particularly while it remains a differentiated strategy? As the saying goes, “It only takes one deal.”

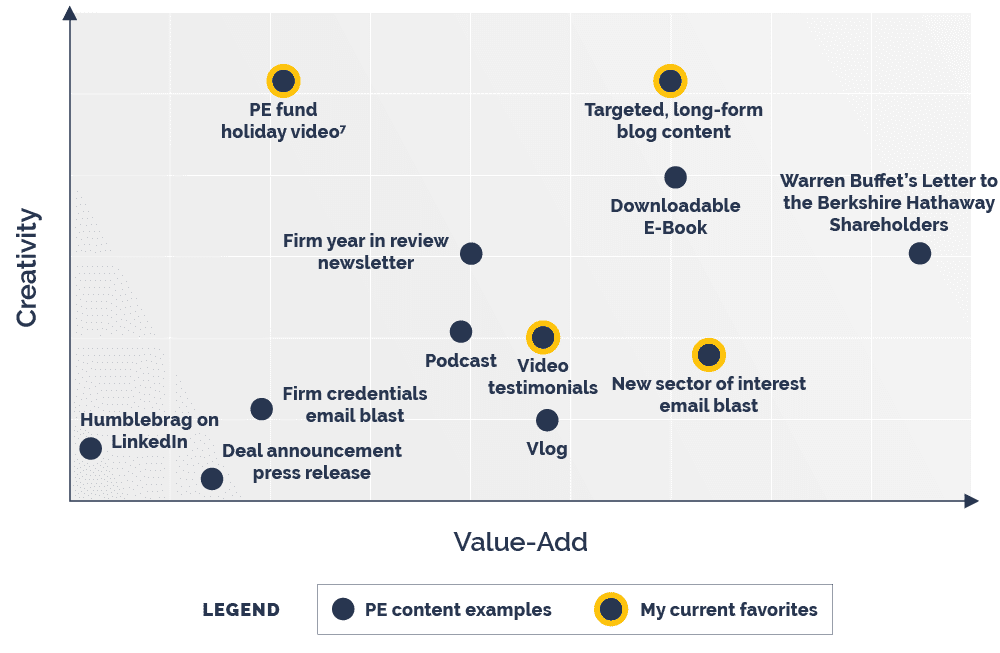

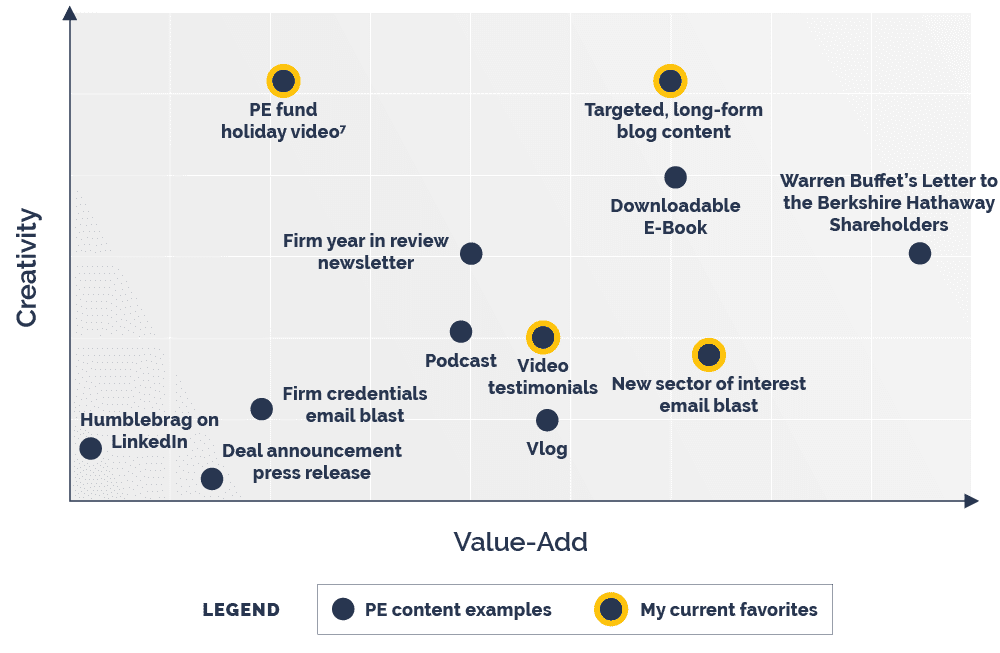

Thanks to the internet, the menu of content marketing options and distribution channels is robust and has given rise to not only blogs but vlogs, video testimonials, podcasts, infographics, E-books and other forms of media. Just take a spin through your LinkedIn feed, and you’ll get a sampling of the major food groups of content marketing at varying levels of quality2. For a time, content marketing in private equity consisted of basic press release posts which, if plotted on a graph where the Y-axis were “creativity” and the X-axis were “value-add”, this strategy could be found in the deep southwest portion of Quadrant 3 (see chart below). However, some early movers are starting to raise the bar for M&A-related content to the benefit of the primary target audiences which include:

-

- M&A industry professionals

- Business owners, generally

- Business owners operating within an industry of specific interest to the PE fund

The tricky part for most PE firms is trying to figure out who is responsible for creating all of this great content. Marketing firms, while good at their craft, are rarely staffed with former investment professionals that can employ the proper voice and perspectives of a PE industry insider. If you then look to the PE professionals themselves, most would just as soon get back to sourcing and/or executing deals and outsource the creative work to someone with a Mac. This creates a double bind unless you can either (i) find an agency that specializes in the M&A industry (there are a few), or (ii) cultivate in-house content capabilities. Neither of these options is necessarily an easy path, but in the words of Tom Hanks’ character in A League of Their Own, “It’s supposed to be hard. If it were easy, everyone would do it. The hard is what makes it great.”

So, I’d like to invite you on a journey to learn about the origins of content marketing, ways to develop high-quality marketing pieces and what to do with them once you have them to source deals. But first, a limerick3:

There once was a firm that invested,

And one day the market suggested,

To put out content,

Or face a descent,

To the place where funds go when they’re bested.

Where Content Marketing Came From

Long before Bill Gates declared “Content is King” in his now famous essay, entrepreneurs and businesses were using early incarnations of content marketing to raise awareness of their products and services. It turns out that Benjamin Franklin himself (of course) is credited with the invention of content marketing when he first published Poor Richard’s Almanack in 1732. PRA contained things like seasonal weather forecasts, puzzles, clever quips4 and other amusements but was really intended to promote his printing business. Some iconic brands followed suit and experienced similar or even better success. Here’s a link to a great infographic that walks through a brief history of content marketing, and the following are some of my favorite examples (with one that I added myself):

| Notable Content Marketing Examples from History |

| Brand |

Year of Inception |

Commentary |

|

1732 |

Benjamin Franklin creates Poor Richard’s Almanack as a way to promote his printing business. PRA ran for over 25 years and sold more than 10,000 copies annually. |

|

1895 |

John Deere publishes The Furrow magazine which was established as, “A Journal for the American Farmer”. The recipe was to incorporate stories that people enjoyed reading and information to help farmers with their own operations, including ways to increase profitability. It is still published today and has been referred to as the agrarian version of Rolling Stone. |

|

1900 |

In an attempt to stimulate demand for automobiles and, consequently, tires, the Michelin5 brothers published a guide for French motorists that featured information about hotels, gas stations, restaurants and other places of interest throughout France. By 1926, the Michelin Guide had standardized the now widely recognized star system for restaurants all over the world with three stars indicating that the cuisine was worth a special journey. |

|

1904 |

Founded in 1897, it didn’t take long for the Jell-O company to get into the content marketing game. Door-to-door salesmen distributed free copies of a recipe book that reportedly contributed to over $1 million in sales by 1906 |

|

1930 |

Procter & Gamble started to broadcast a radio serial drama sponsored by their Oxydol soap powder. The company intended to build brand loyalty amongst adult women through this programming, and its success resulted in the birth of what we now know as the soap opera. |

|

1965 |

Warren Buffett debuts his now famous Berkshire Hathaway Letters to Shareholders. Early versions were, admittedly, pretty dry, but ultimately evolved to incorporate more approachable commentary and plugs for the brands in which BH was invested. These letters don’t always get put into the content marketing category, but I think they are an excellent example. |

|

2014 |

The debut of the Lego Movie arguably represents the first example of a major studio film doubling as a branded content marketing piece. |

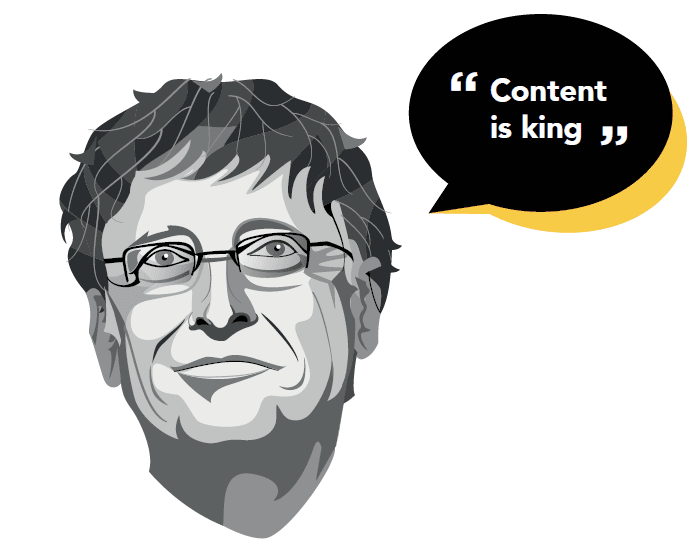

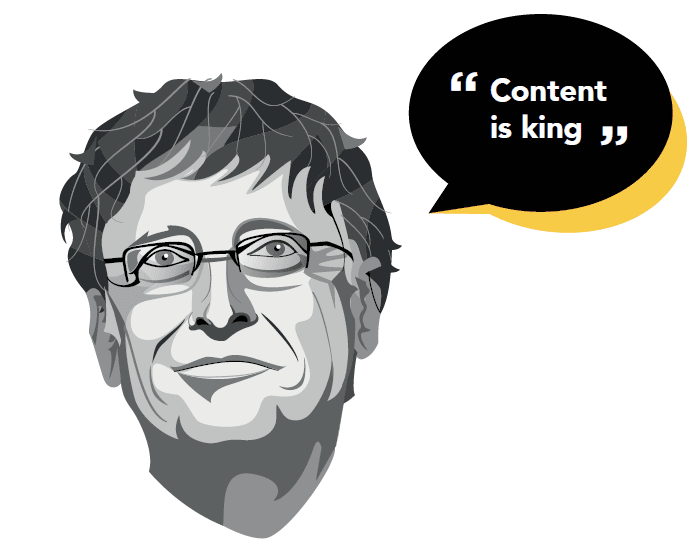

Content and the internet go together like lamb and tuna fish6. In 1996, Bill Gates presciently analogized the arrival of the internet to the television revolution and dropped the following gems on us which have served as the north star of many a content strategy:

| Selected Quotes from Bill Gates’ Essay “Content is King” |

| Quote |

Punchline |

| “Content is where I expect much of the real money will be made on the Internet, just as it was in broadcasting.” |

We’ve seen this movie before |

| “…the long-term winners were those who used the medium to deliver information and entertainment.” |

Content will trump hardware |

| “…anyone with a PC and a modem can publish whatever content they can create. It allows material to be duplicated at low cost, no matter the size of the audience.” |

Content publishing & dissemination will be democratized |

| “If people are to be expected to…turn on a computer to read a screen, they must be rewarded with deep and extremely up-to-date information…” |

Make your content good |

| “Those who succeed will propel the Internet forward as a marketplace of ideas, experiences, and products – a marketplace of content.” |

The winners will elevate the standard of content to the benefit of everyone |

In summary, content marketing has been around for a long time, some very well-respected companies have used it successfully, and the internet was essentially made for the dissemination of content. It’s time the private equity industry got on board. The good news is that there are some tested and proven strategies that marketers have embraced in other arenas from which investors can borrow and that are profiled below.

How to Have Good Content Marketing

Here are some guidelines to enhance your odds of creating content that is informative, entertaining, humorous, alluring, memorable, shareworthy, vulnerable, etc. These rules have been synthesized from some of the great writers, storytellers, philosophers, academics, entertainers, marketers and business minds that mankind has produced.

1. Wait for Inspiration

With all of the content swirling around, it’s easy to feel compelled to just start distributing marketing pieces so that you can allay your FOMO and get in on the fun. Agencies don’t help in that they will frequently push to get you on a content calendar for a consistent cadence of distribution. Resist the temptation to do this. Rather, wait for the topic or idea that you just can’t shake. Wait for the creative impulse that keeps coming back to you, and learn what it feels like when true inspiration strikes. This is how you end up with marketing pieces that other people will want to consume.

2. Solve Pain Points

In the fable of Androcles and the Lion, Androcles, a runaway slave, happens upon the den of a wounded lion from whose paw he removes a large thorn. This act effectively tames the lion who then shares his food with Androcles. Years later, when Androcles is caught and condemned to be devoured by the same lion, the lion refuses and unexpectedly shows affection to Androcles. This story is a useful archetype for how you want those in business who control your destiny to respond to you. Consider this – LinkedIn posts with “How To” in the title earn a 46% increase in average views while posts that pose a question in the title (which introduce the pain of having to think about an answer the question) experience 15% fewer views than all other post types.

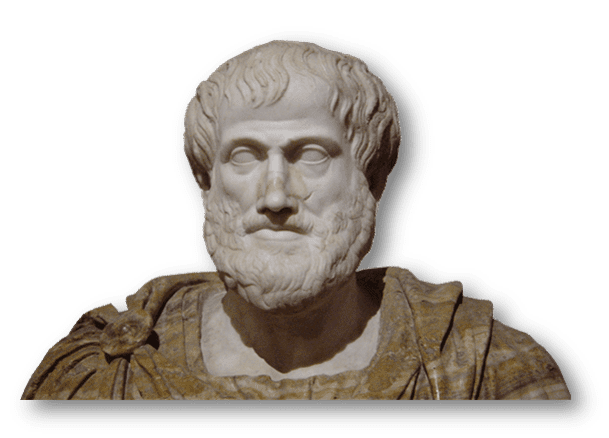

3. Ethos, Pathos, Logos

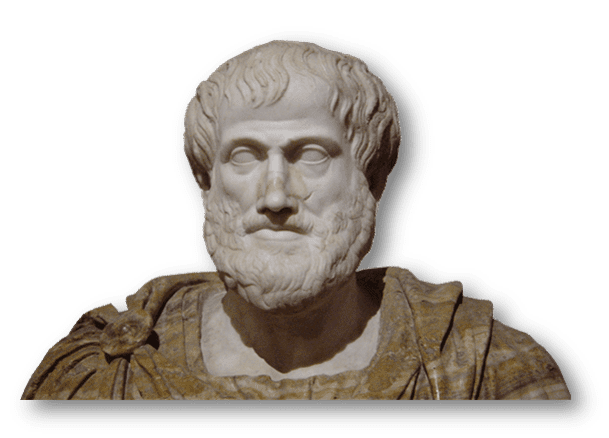

Between 367-322 BC, Aristotle developed what is called the Aristotelian Triad, or The Rhetorical Appeals. Rhetoric is defined as the art of persuasion, and its building blocks are Ethos, Pathos and Logos. Ethos, in this context, refers to the character or reputation of the speaker. The better the reputation, the more persuasive he or she is likely to be. Pathos is the speaker’s ability to evoke emotion from the audience, and Logos entails the use of logic to make a point. When coupled together, you’ll have the audience eating out of the palm of your hand. Not surprisingly, the highest viewed Ted Talks are a master class on incorporating the Rhetorical Appeals.

4. Be a Good Storyteller

Storytelling, in various forms, has been around for over 30,000 years, and there’s something about it that makes it effective in memorializing valuable information. The science suggests that in response to a captivating story, the brain releases dopamine making the story easier to remember and with greater accuracy. Therefore, a marketer’s motivation to be a good storyteller is to have their content sought after and remembered. For some tips on being a great storyteller, check out Kurt Vonnegut’s classic “8 Rules…” list. My favorite is Rule #1 – Use the time of a total stranger in such a way that he or she will not feel the time was wasted.

5. “Quality is the Best Business Plan”

There’s too much cyber noise being secreted online by people that aren’t doing themselves or their brands any favors. Pixar’s former Chief Creative Officer John Lasseter said, “Quality is the best business plan.” Hard to argue with the Ethos (see #3 above) of a guy like that. In a related sentiment, Steve Martin said, “Be so good they can’t ignore you.” The point is that once inspiration strikes and you have something to say, put all of your energy into making your marketing pieces as good as possible. You want your brand to be irrefutably associated with quality.

6. Be Authentic

Sometimes it can be tricky to navigate an overly cautious compliance protocol, but do your best to stay away from using hyper-sanitized or inauthentic corporate speak in your marketing materials. If you want to have any shot at evoking Pathos (see #3 above) in your audience, you need, at the very least, to be authentic, and it’s even better if you can be constructively vulnerable. If you find yourself non-ironically using words / terms like “industry agnostic”, “value proposition”, “liaise”, “work hard / play hard” or “crossed my desk”, then stop what you are doing and start again. And, whatever you do, don’t you dare employ humblebragging. Remember, it’s the authentic humanity embedded within content that often makes it effective.

7. Adapt to Changing Attention Spans

It’s been proven that the way people consume content changes based on the medium in which the content is delivered. For instance, a person holding a physical book is more likely to comprehensively read the material vs. a tendency to skim and look for main points when reading online. Therefore, make sure to consider where and how your content will be consumed and adapt accordingly. Some quick tips for electronic consumption include the use of bullet points when possible, dividing your content into large and simple headings, and including imagery.

After arming yourself with the rules above, you then have to decide to which medium you’d like to apply them. The chart below plots some of the typical PE firm content marketing varieties based on creativity (Y-axis) and value-add to the recipient (X-axis). My present favorites are highlighted in orange.

What to Do with Your Content Marketing (and When)

Ok, so you’ve developed some nice content and are ready to distribute it to your target audience that’s awaiting your perspectives with the anticipation of a baby bird at breakfast. Here are some options with the respective pros and cons of each channel from the lens of a PE firm.

| Common Content Marketing Distribution Channels for PE Firms |

|

|

|

|

|

|

|

| Channel |

Firm Website |

Social Media |

Email Blast |

Direct Mail |

In Person |

Virtual |

| Advantages |

- Logical place for marketing assets

- Improves SEO

- Stimulates engagement with other parts of your website

- Exposes audience to your firm’s brand experience

|

- Reaches wide audience

- Stimulates engagement & new contacts

- Keeps firm in the “conversation”

- Can result in incremental deal flow

|

- Reaches wide audience

- Can segment marketing lists based on audience

- Can drive traffic to website

|

- High response rates (50%+) when done well

- Differentiated in that it is not an electronic medium

- Can introduce tangible personalization

|

- Positions individual as a thought leader

- Keynotes more powerful than panels

- Humanizes firm

|

- Reaches wide audience

- No travel required

- Builds brand association with specific industries / topics

|

| Limitations |

- Need to supplement with lead capture tech to be useful for deal sourcing

- Sending only to subscribers will not reach as wide an audience as other channels

|

- Time consuming to regularly post high-quality content

- Content must be targeted / industry-specific to source differentiated deal flow here

|

- Low engagement

- Too easy to delete / ignore

- People get too many emails

- Can result in “unsubscribes”

|

- Remote work may make it hard to reach decision maker

- Increases lead acquisition cost

- Must be highly personalized to elevate response rates

|

- Typically, fairly episodic in frequency

- Less feasible during COVID era

- Audience needs to be sizeable and relevant

|

- Typically, fairly episodic in frequency

- Short bursts of activity before / after the event

- TBD if will remain relevant in post-COVID era

|

| Other Commentary |

- Look to management consulting websites for what PE websites should aspire to

|

- LinkedIn is becoming Instagram for the business community → learn the game

|

- Must use segmented contact lists so that recipients receive relevant content

|

- Do whatever you can to stand out; make packages highly personalized

|

- Would expect a flurry of in-person content marketing events post-COVID

|

- Leverage LinkedIn to promote participation before / after event

|

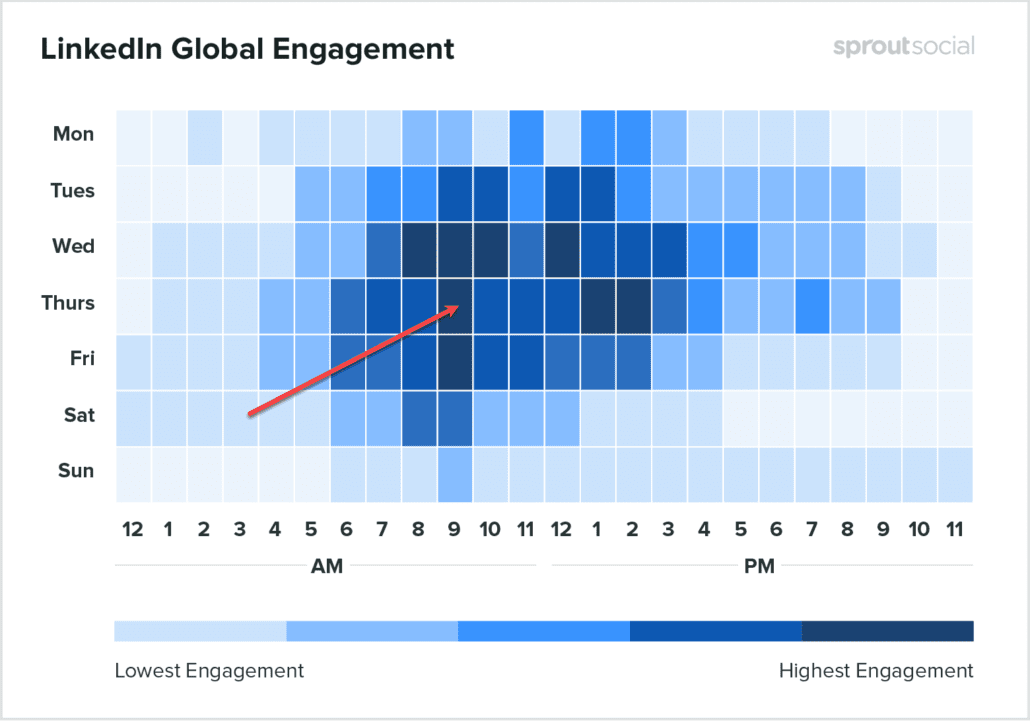

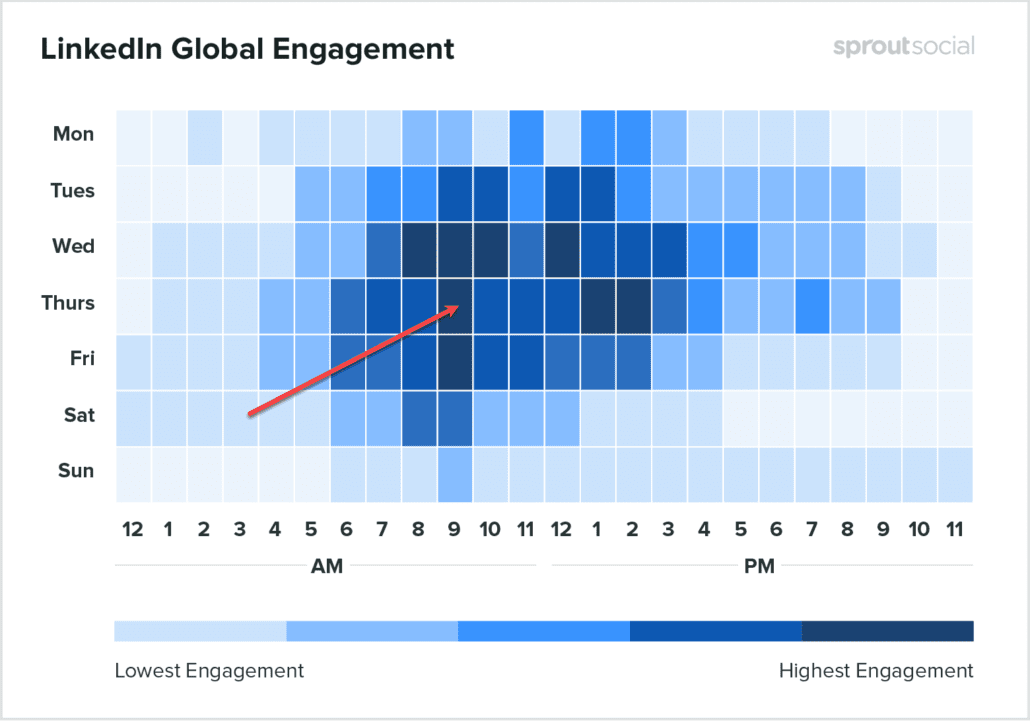

Since LinkedIn is rapidly becoming Instagram for the business community (and with the corresponding addictiveness), here are some tips for how to optimize for engagement. The most common question people ask is about the best day and time to post content. The answer to that question is a bit of a moving target, so it’s good to stay current on the latest guidance. Back in August 2020, Sprout Social published a great piece that examined the optimal times to post on the major social media platforms. Based on the social media activity of over 20,000 of their own clients, they suggested the following pertaining to LinkedIn:

- Best times: Wednesday from 8–10 am and noon, Thursday at 9 am and 1–2 pm, and Friday at 9 am

- Best day: Wednesday and Thursday

- Worst day: Sunday

The heat map below presents their findings visually:

Other LinkedIn Posting Tips

Here are some other useful LinkedIn posting tips8. Those highlighted in yellow are those that I’ve incorporated into this blog:

- Make your titles 40-49 characters in length

- Include 8 images

- Use “How To” style headlines

- Divide your post into 5, 7 or 9 headings

- Make it between 1,900-2,000 words long

- Use neutral language (i.e. not overly positive or negative)

- Write at an 11-year old reading level

- Request likes to boost engagement

How to Measure Success

Vanity of vanities; all is vanity. Ok, not everything is vanity, but guard yourself against “vanity metrics”. Vanity metrics include things such as website traffic, open rate, click through rate, likes, comments, etc. A good rule of thumb is to proceed with caution around any metric that feeds the ego. Yes, these metrics exist in the upper realm of a funnel somewhere, but all you really need to measure is…

DEALS YOU WOULD NOT

HAVE SEEN OTHERWISE.

Conclusion

Even with all of this information, generating incremental deal flow from content marketing is still hard. However, it’s like Tom Hanks said, “…it’s the hard that makes it good.” If anyone hung in there to get to the end of this piece, I applaud your dedication and encourage you to like or comment on LinkedIn. It would be great to hear from you.

_______

1The average blog post takes ~4 hours to write, and there’s a positive correlation between amount of time spent on a blog and its effectiveness from a content marketing perspective. This supports the notion that, “Quality is the best business plan,” a quote referenced later in this piece.

2The most irritating of which is the array of “double tap” posts that trick you into liking their content to artificially inflate their engagement stats. Having fallen for this in the past, I feel it’s my duty to raise awareness of the genre. Don’t do it. It’s sort of like feeding a wild animal – it only encourages them.

3Why? Because it’s fun and challenging. And, I’m offering a TBD prize for the best (tasteful) limerick posted in the comments section.

4My favorite of which being, “Three can keep a secret, if two of them are dead.”

5Fun fact: The Michelin Man’s nickname is Bibendum inspired by the phrase “Nunc est bibendum” (Now is the time for drinking). The idea was that a corpulent, fun-loving mascot would pair well with the epicurean ethos of the Michelin Guide.

6It’s from Billy Madison. If you don’t get it, swap “lamb and tuna fish” with ”peanut butter and jelly”.

7While often silly and awkwardly acted, these videos go a long way in humanizing a firm.

8The artist in me doesn’t always adhere to these guidelines, but I try to whenever possible.

About ClearLight Partners

ClearLight is a private equity firm headquartered in Southern California that invests in established, profitable middle-market companies in a range of industry sectors. Investment candidates are typically generating between $4-15 million of EBITDA (or, Operating Profit) and are operating in industries with strong growth prospects. Since inception, ClearLight has raised $900 million in capital across three funds from a single limited partner. The ClearLight team has extensive operating and financial experience and a history of successfully partnering with owners and management teams to drive growth and create value. For more information, visit www.clearlightpartners.com.

Disclaimer: The views and opinions expressed in this blog are solely my own and do not necessarily reflect any ClearLight opinion, position, or policy.

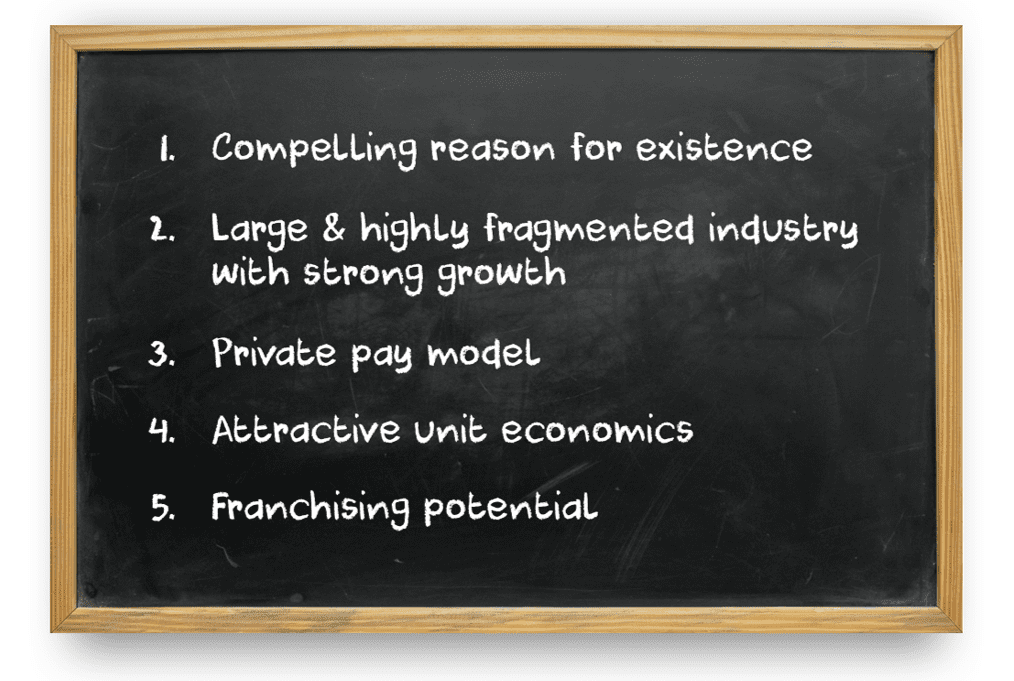

1. At-Home Convenience Services

1. At-Home Convenience Services 2. Recurring Revenue

2. Recurring Revenue 3. Remote Monitoring

3. Remote Monitoring 4. Small, Consummable Luxuries

4. Small, Consummable Luxuries 1. Outpatient Behavioral Health

1. Outpatient Behavioral Health 2. Express Car Washes

2. Express Car Washes 3. Fitness

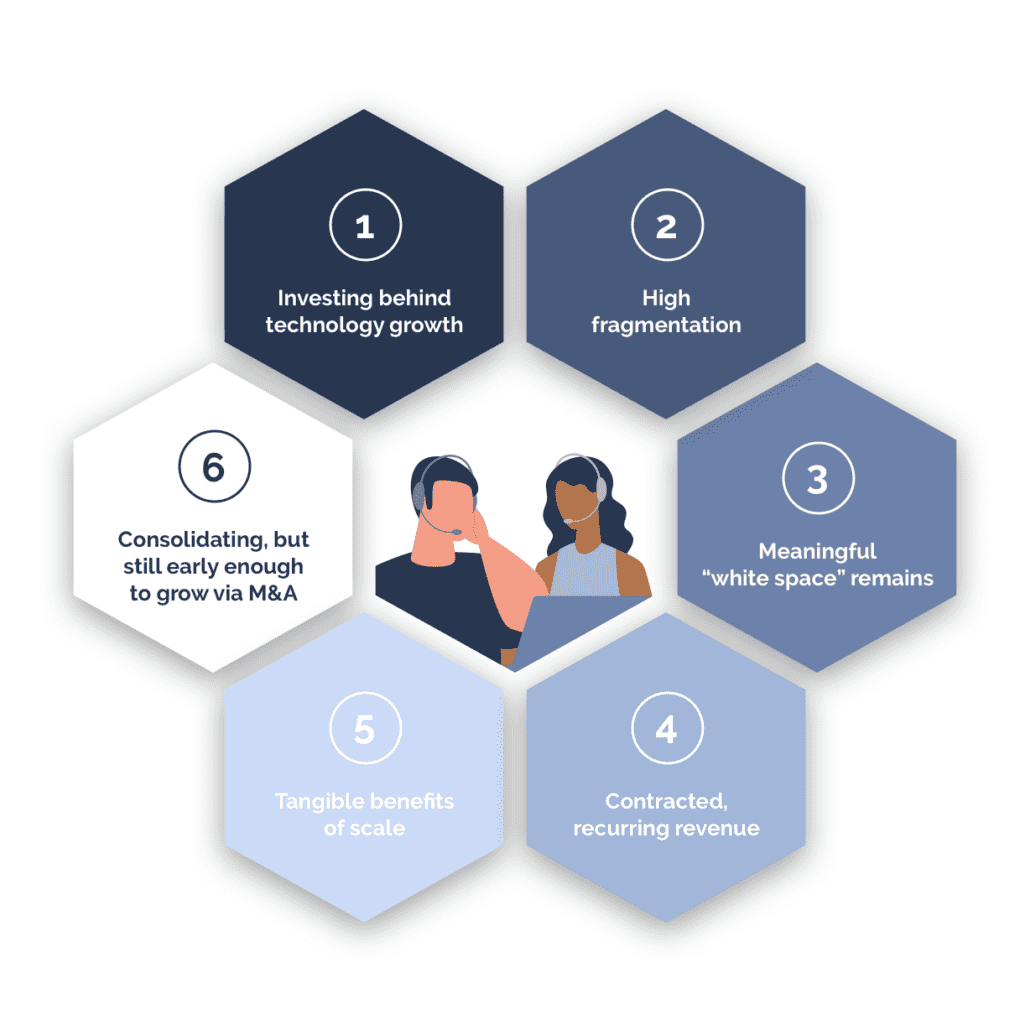

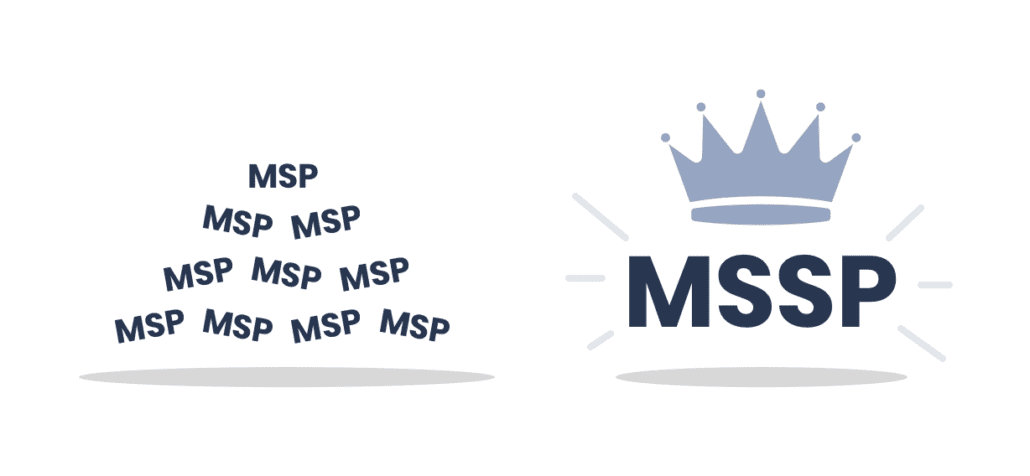

3. Fitness 4. IT and Other Tech-Enabled Services

4. IT and Other Tech-Enabled Services

1. Higher Value-Added Service Offering

1. Higher Value-Added Service Offering 2. Strong Recurring Revenue Profile

2. Strong Recurring Revenue Profile 3. High Client Retention

3. High Client Retention 4. Longer Contract Terms are Better

4. Longer Contract Terms are Better 5. History of (Successful) Acquisitions

5. History of (Successful) Acquisitions 6. Sophisticated Client Acquisition Engine

6. Sophisticated Client Acquisition Engine 7. Client and End Market Diversity

7. Client and End Market Diversity 8. History of Adaptation to Technology and Industry Change

8. History of Adaptation to Technology and Industry Change

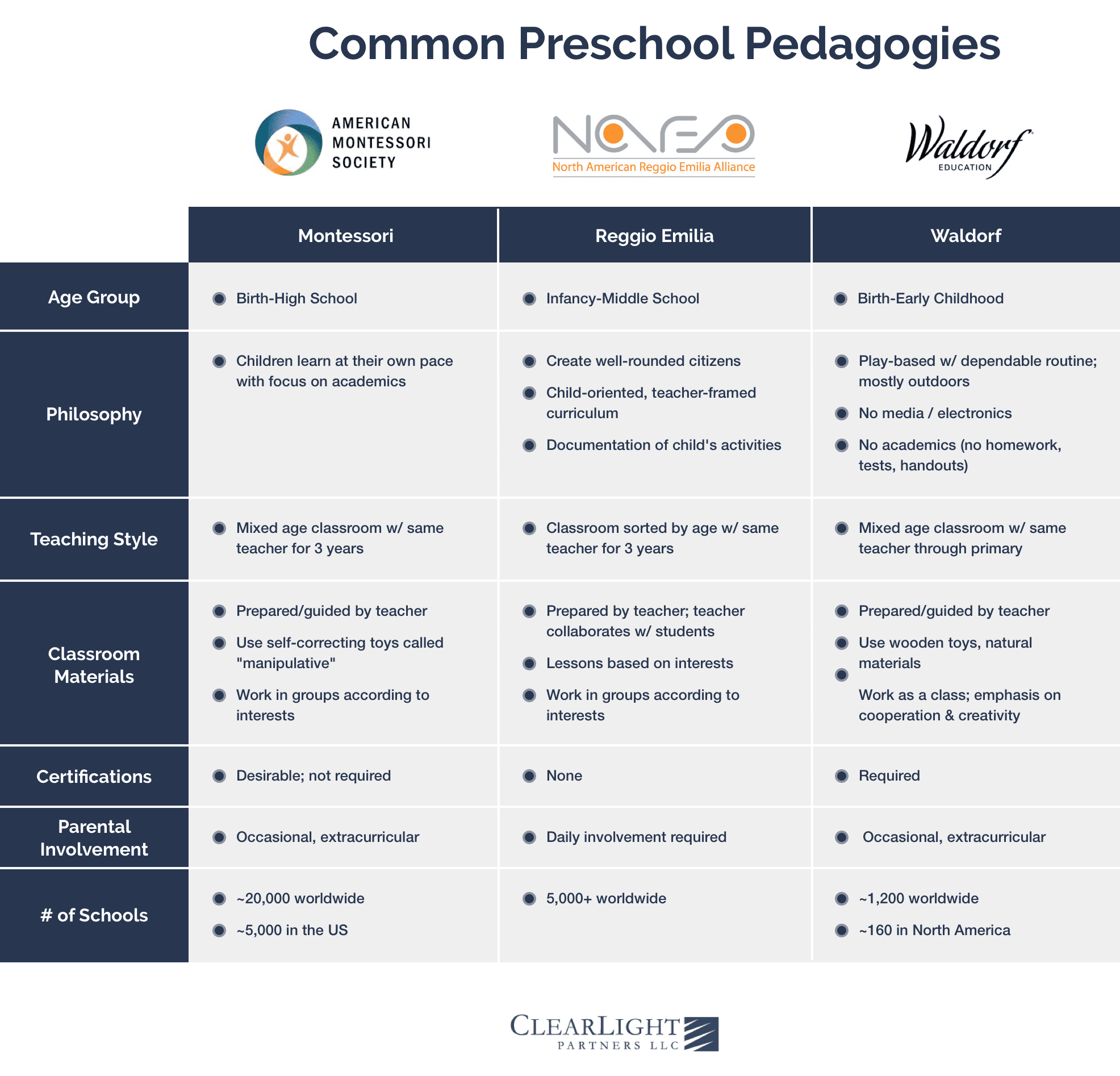

The Montessori educational philosophy was developed by

The Montessori educational philosophy was developed by

1. Sufficient Child Capacity to Support Critical Mass

1. Sufficient Child Capacity to Support Critical Mass 2. Utilization Indicative of Parent / Community Satisfaction

2. Utilization Indicative of Parent / Community Satisfaction 3. Reasonable Operating Tenure

3. Reasonable Operating Tenure 4. Relevant Accreditation

4. Relevant Accreditation 5. Strong Reputation; Proven Results

5. Strong Reputation; Proven Results 6. EBITDA Margins in Excess of 20% for Mature Schools

6. EBITDA Margins in Excess of 20% for Mature Schools  7. Multi-Site Presence

7. Multi-Site Presence 8. No Headline Issues

8. No Headline Issues

1. Wealth Diversification

1. Wealth Diversification 2. Team Development

2. Team Development 3. Business Building

3. Business Building 4. Financial Sophistication

4. Financial Sophistication 5. Capital For Growth

5. Capital For Growth 6. “Two Bites of the Apple”

6. “Two Bites of the Apple”