Franchisors vs. Franchisees: Why Private Equity Likes Both

Read time: 4 minutes

“Long-term consistency beats short-term intensity.” (Bruce Lee)

Introduction & Definitions

It’s official, private equity investors like franchises. This wasn’t always the case, but in recent years, there’s been a wave of private equity funds investing behind multi-unit concepts of all varieties. During 2018, significant franchisor acquisitions by private equity funds included Jamba Juice ($200 million), Sonic Drive-In ($2.3 billion) and Zoe’s Kitchen ($300 million) to name a few. In 2019, we’ve seen CorePower Yoga, Hooters and Whataburger attract new investors. What’s interesting is that a historical preference for franchisors has become more balanced in that private equity funds are starting to take material interest in franchisees as well. So, we thought it was worth exploring the nuances between the franchisor and franchisee model and explaining a few of the reasons why private equity sees strong investment returns potential in both strategies.

To start, let’s define the relevant terms1 :

- Franchisor – The entity that establishes a brand’s trademark or tradename and a business system. Franchisors make money by charging its franchisees up-front fees and royalties as a percentage of revenue, typically around 5-6% (though there are exceptions to this rule of thumb).

- Franchisee – Often a small business owner that pays a royalty and an initial fee for the right to do business under the franchisor’s name and system. Outside of royalties and, sometimes, marketing or other fees, the franchisee keeps whatever profits they generate from operating their business. When successful, it’s common for franchisees to own multiple units within a franchised system.

A Brief History of Franchising in the U.S.

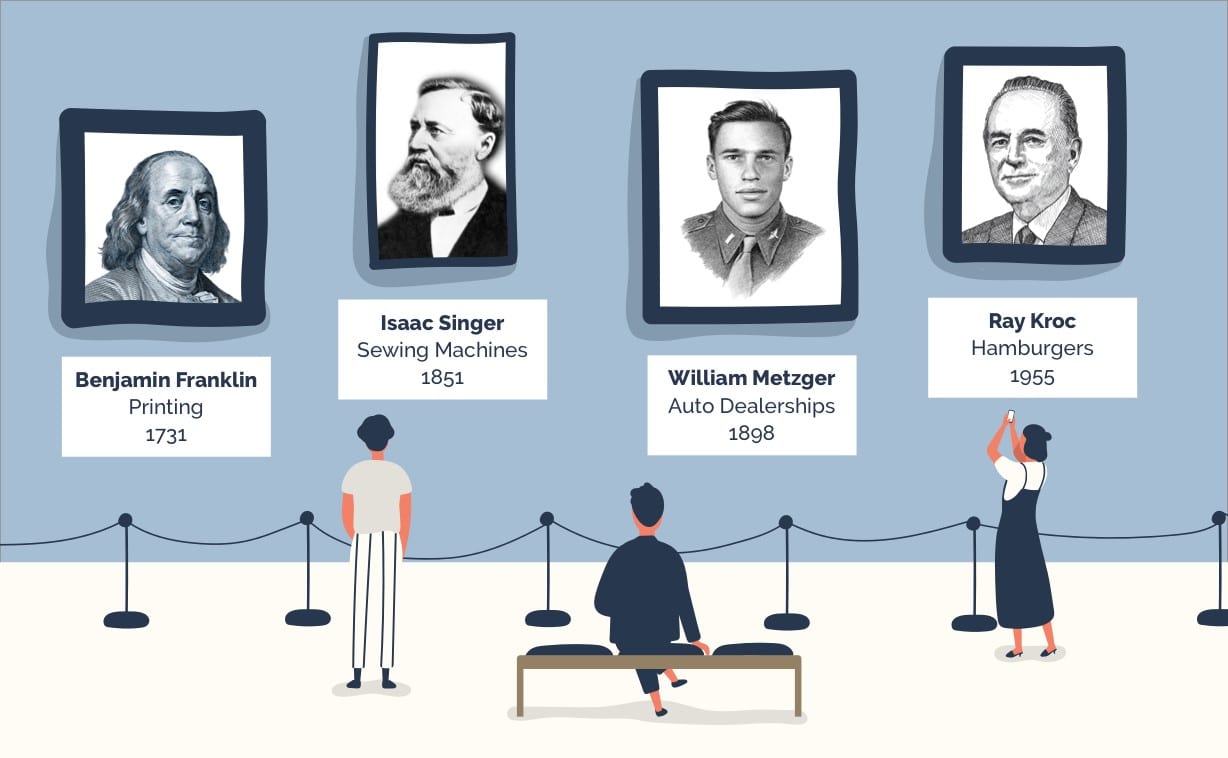

Not only was he one of the Founding Fathers of the United States but, you guessed it, Benjamin Franklin instituted the first franchise system in 1733. When he wasn’t busy inventing the lightning rod, bifocal glasses, swim fins, a stove bearing his name, and a much-needed update to a sadistically inflexible urinary catheter, Mr. Franklin evidently found time to strike a deal with one Thomas Whitmarsh to establish Whitmarsh as a printer in Charleston, SC. The deal was that Franklin would rent space for the printing operation and provide any equipment in exchange for one third of the profits over a six-year period. At the end of the term, Whitmarsh would be able to buy the equipment back from Franklin and work for himself free and clear. Whitmarsh went on to print such reads as the South-Carolina Gazette and local copies of Poor Richard’s Almanack. Franklin replicated this model in other cities that had either no printers or light competition by partnering with employees that demonstrated good work ethic.

Despite Franklin’s earlier claim, many sources credit Isaac Singer, the founder of sewing machine manufacturer Singer Corporation, with the creation of the modern franchising model in the mid 1800’s. Like Franklin, Singer used franchising as a means to quickly expand. Singer distributed his sewing machines throughout the U.S. via a network of licensees that paid both a licensing fee and were required to teach people how to use the sewing machines.

The bottom line is that franchising has been around for hundreds of years and has withstood the test of time. Thanks to these and other founding fathers2 of franchising, the U.S. is now home to over 700,000 franchised businesses. While there are not yet as many private equity firms in the U.S., perhaps 1-2 thousand depending on who you ask, the amount of capital they have raised should make it no surprise that they’ve discovered ways to generate strong investment returns in franchisors and franchisees alike.

What PE Firms Want to See in a Franchise System

Investment criteria across private equity firms for franchises may vary, but it’s safe to assume that most professional investors are going to look for one more of the following attributes when looking to back a franchisor or franchisee:

| What a “Good” Franchise Looks Like to a PE Fund | |

|---|---|

Product or Service that is Staightforward and Can be Consistently Replicated Product or Service that is Staightforward and Can be Consistently Replicated |

A system’s growth will usually be driven by franchisees, so the product or service needs to be something that can be quickly mastered by a small business owner and/or employees that may not have prior experience in the industry. Further, franchisees will need to consistently meet the brand standards set out by the franchisor such that the system upholds a consistently strong reputation across its network of operators. |

Product or Service that is Sustainably “On Trend” Product or Service that is Sustainably “On Trend” |

Systems that benefit from sustainable and easy to understand tailwinds are going to be more attractive to private equity investors. Most private equity funds are adept at discerning trends from fads, so if the shiny new product doesn’t appear to have staying power, then they may pass on making an investment. |

Universal Appeal Across Geographies3 Universal Appeal Across Geographies3 |

Some products or services may be relatively more embraced in certain geographies than others. A good example might be a food concept that is cherished in one part of the country but is not portable to other markets based on regional dietary preferences. So, investors will look for systems that are thriving within their original markets as well as new markets that they’ve entered. Example: Have you ever been to a part of the country that doesn’t have a McDonald’s? |

Sufficently Long Operating History Sufficently Long Operating History |

Much like how investors evaluate non-franchised businesses, it’s comforting if a franchise has an operating history that suggests long-term viability. If a system is too young, investors may pause in favor of those with more longevity. |

Critical Mass of Units Critical Mass of Units |

Systems that offer a critical mass of units, say 50 or more, tell investors a few things. First, they’ve been able to attract a good number of franchisees who were willing to incur the fees, development costs and risk associated with starting up a new location. Second, if the locations have been open for a while, then it suggests longer-term viability of the concept, though investors will also want to know how many locations have closed. Third, the larger the system, the more resources a franchisor will have to support their growing network in areas like marketing. Lastly, larger systems will have survived a lot of growing pains that smaller franchises experience and often emerge more ready to support future growth. |

Good Unit Economics Good Unit Economics |

Unit economics are the financial investment and results one might expect in opening and operating a single location. The basic ingredients to a good unit economic profile include return on investment (ROI) from build-out costs and same-store-sales growth, but there are a lot of metrics one can analyze within a franchised system. For more information on unit economics see “A Crash Course on Unit Economics” below. |

Successful Franchisees Successful Franchisees |

Good franchisors want franchisees to be successful and happy. It’s a good sign if you see a high incidence of multi-unit franchisees – this suggests that a franchisee was sufficiently happy with the result of their first location to open additional locations. Systems with successful franchisees will be better at attracting new franchisees and have better prospects for growth. |

Runway for Future Growth Runway for Future Growth |

PE funds want to see that systems offer sufficient “white space” to permit growth during their ownership period and beyond such that they’ll be able to attract buyers when they seek to exit. In other words, there needs to be enough undeveloped territories to allow future investors to make a good return on their investment. |

A Crash Course on Unit Economics

Given what is often a large number of units operating within a franchise system, there is no shortage of data that can be analyzed. However, the essential metrics for most investors are relatively straightforward and relevant across franchised concepts. The good news is that some of these metrics will be profiled in the Franchise Disclosure Document (FDD). The graphic below summarizes how investors will usually look at and assess unit economics:

| Common Unit Economics Analyzed by Private Equity Investors | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

|

|

||||||||||||

|

|

|

|

The Pros and Cons4 of Franchisors vs. Franchisees

Now that we’ve covered what franchising is, its history, what an investor looks for in a franchised business, and the ABCs of unit economics, we can finally share why investors like investing in both franchisors and franchisees. Like any sector, there are positives and negatives, but for many investors the pros far outweigh the cons in franchising. The following table highlights the respective merits and limitations of investing in franchisors and franchisees from an investor’s perspective:

Conclusion

We hope this sheds some light on how private equity funds evaluate franchises and why they have made substantial investments into both models. As always, we’re here to help, so give us a call to start a conversation.

_______

1Definitions from franchise.org.

2William Metzger (pictured above) purchased the first independent car dealership from General Motors in 1898. By working with franchisees in exclusive territories, OEMs like GM and Ford were able to bring their products to market more efficiently, and over longer distances. Famously, Ray Kroc (above) opened the first McDonald’s franchise restaurant in 1955. Shortly thereafter he set up the company that would become the McDonald’s we know today. By working with franchisees across the U.S., Kroc grew his system to over 100 restaurants by 1959.

3The exception to this rule is if a concept is more regional yet the region supports a sufficiently large addressable market.

4Believe it or not, Benjamin Franklin is also credited with developing the idea of a Pros and Cons list.

About ClearLight Partners

ClearLight is a private equity firm headquartered in Southern California that invests in established, profitable middle- market companies in a range of industry sectors. Investment candidates are typically generating between $4-15 million of EBITDA (or, Operating Profit) and are operating in industries with strong growth prospects. Since inception, ClearLight has raised $900 million in capital across three funds from a single limited partner. The ClearLight team has extensive operating and financial experience and a history of successfully partnering with owners and management teams to drive growth and create value. For more information, visit www.clearlightpartners.com.

Disclaimer: The views and opinions expressed in this blog are solely my own and do not necessarily reflect any ClearLight opinion, position, or policy.

Build-Out Costs

Build-Out Costs Time to Profitability

Time to Profitability Time to Recoup Build-Out Costs

Time to Recoup Build-Out Costs Time to Maturity

Time to Maturity Mature Revenue, or “Average Unit Volume”

Mature Revenue, or “Average Unit Volume” Mature EBITDA

Mature EBITDA Build-Out Costs / Mature EBITDA

Build-Out Costs / Mature EBITDA Same-Store Sales Growth

Same-Store Sales Growth