Read time: 3-4 minutes

“Information technology and business are becoming inextricably woven. I don’t think anybody can talk meaningfully about one without talking about the other.” (Bill Gates)

Introduction

Something is up in the world of IT services. Investors are flocking to MSPs like the salmon of Capistrano1. By my last count there are now approximately two dozen PE-backed MSP platforms in the U.S., and the majority of this deal activity has transpired within the last three or so years. So, why now has a sector like IT Services, historically less of a focus for private equity investors, stimulated so many transactions? Well, come along with me on a journey into the history of IT Services to find out where MSPs came from, where they are now, and the specific attributes that have compelled investors to place big bets on the sector. To start, let’s define what an MSP is.

- An MSP, or Managed Services Provider, is a business that, on an outsourced basis, provides the following primary services to businesses of all sizes and across industries:

- Subscription-based management of cloud-based, on-premise & other IT assets;

- Onsite project-based services (e.g. network design, deployment & repair); and

- Hardware / software re-selling & implementation

In short, MSPs are delivering the same services your in-house IT guy2 used to offer onsite but now on an outsourced basis, and often remotely. However, this wasn’t always the case. In fact, MSPs weren’t even always referred to as MSPs. The following section will explain how IT services companies have evolved into their current form.

A Brief History of the IT Services Industry

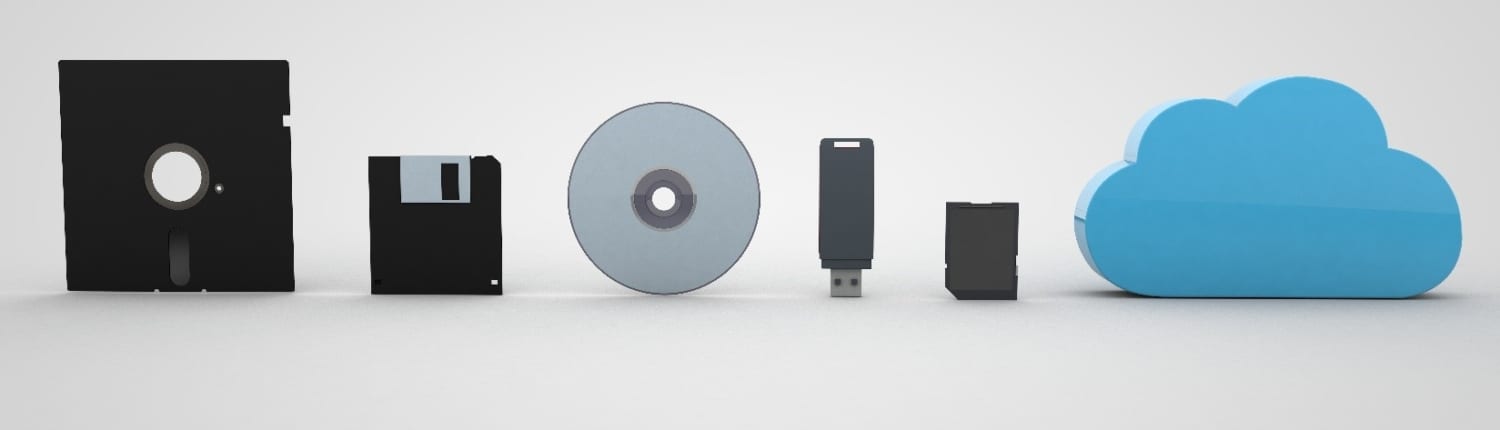

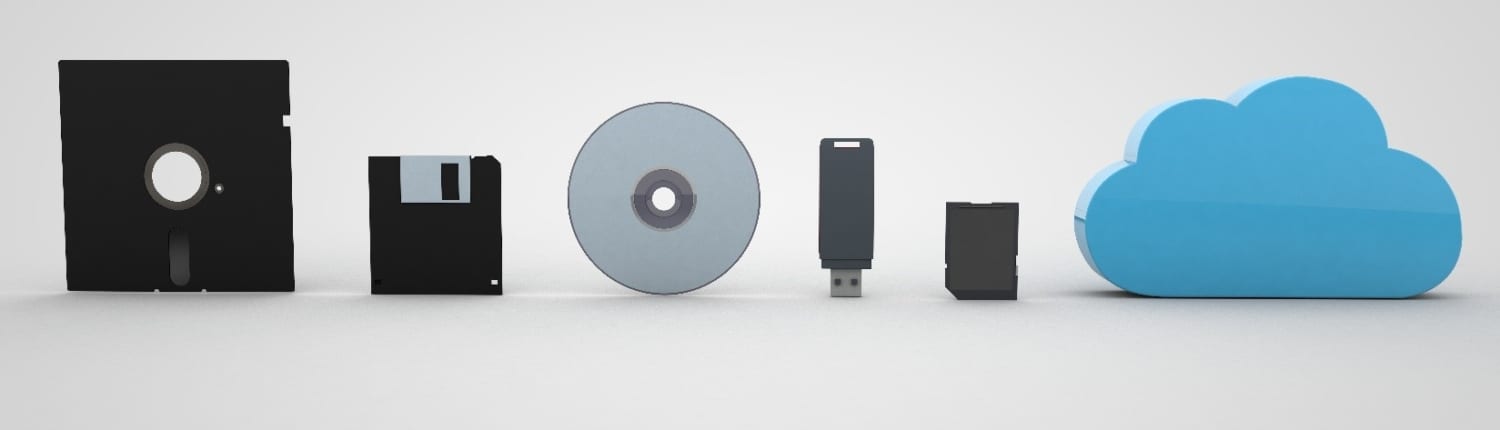

The need for IT support emerged alongside widespread adoption of technology, which in the earliest years simply meant a transition away from legacy communication and productivity methods to the use of computers. And, with more computers came more opportunity for things to break. Thus, the IT Services companies of the 80’s that initially focused primarily on hardware re-selling to participate in the rapid growth of business computing inevitably found their way to break/fix services when issues emerged that customers weren’t capable of or inclined to solve on their own. So, if you’ve ever heard the term “VAR”, or value-added re-seller, this simply referred to an entity that provided hardware and/or software but also the ancillary services to assist with technology implementation, maintenance and repair. What’s really interesting is that everyone saw the growth of IT Services coming. In an article in the Washington Post from December of 1981, it was written, “Computer service technicians – the people who install, test and maintain the equipment – will experience the fastest job growth in the industry.”4 It just took a while for VARs to become MSPs.

The transition from VAR to MSP began in the 90’s, though this was well before any widespread awareness of what managed services was or would become. This evolution was facilitated, in part, by the emergence of application service providers (ASPs) which allowed for the remote monitoring and management of IT infrastructure. Initially, remote monitoring and support was focused on servers and networks, though the scope of service ultimately expanded to include mobile device management, managed security, remote firewall administration, security-as-a-service, and managed print services.

In 2005, the modern MSP business model began to take shape, and three individuals – Karl Palachuk, Amy Luby and Erick Simpson – are credited with having pioneered the new recurring revenue model. In fact, both Paluchuk and Simpson published books on the topic of managed services in 2006, and the MSP model began to take hold with adoption led by enterprise-level clients. Consequently, savvier VARs migrated their businesses to higher margin, recurring revenue models and tailored service offerings to the needs of the small-and-medium sized business (SMB) community. Since then, SMBs have responded favorably to the MSP model. The key drivers for outsourcing IT support in the current environment include a need for:

- A more proactive and strategic approach to IT given that management of IT resources is non-core to most businesses

- Maximizing “uptime” to mitigate the risk of disruption from technology malfunction

- Enhanced risk management / compliance support in light of regulatory requirements that can put an outsized burden on SMBs

- Cost savings / better forecasting – MSPs often provide for cheaper and more predictable costs (via fixed monthly fees) relative to in-house resources

- Access to newer technologies to keep pace with change and cybersecurity needs

Today, the global managed services market is estimated to reach over $250 billion by 2022 with an expected growth rate in excess of 10%.

Why Private Equity Funds Like MSPs

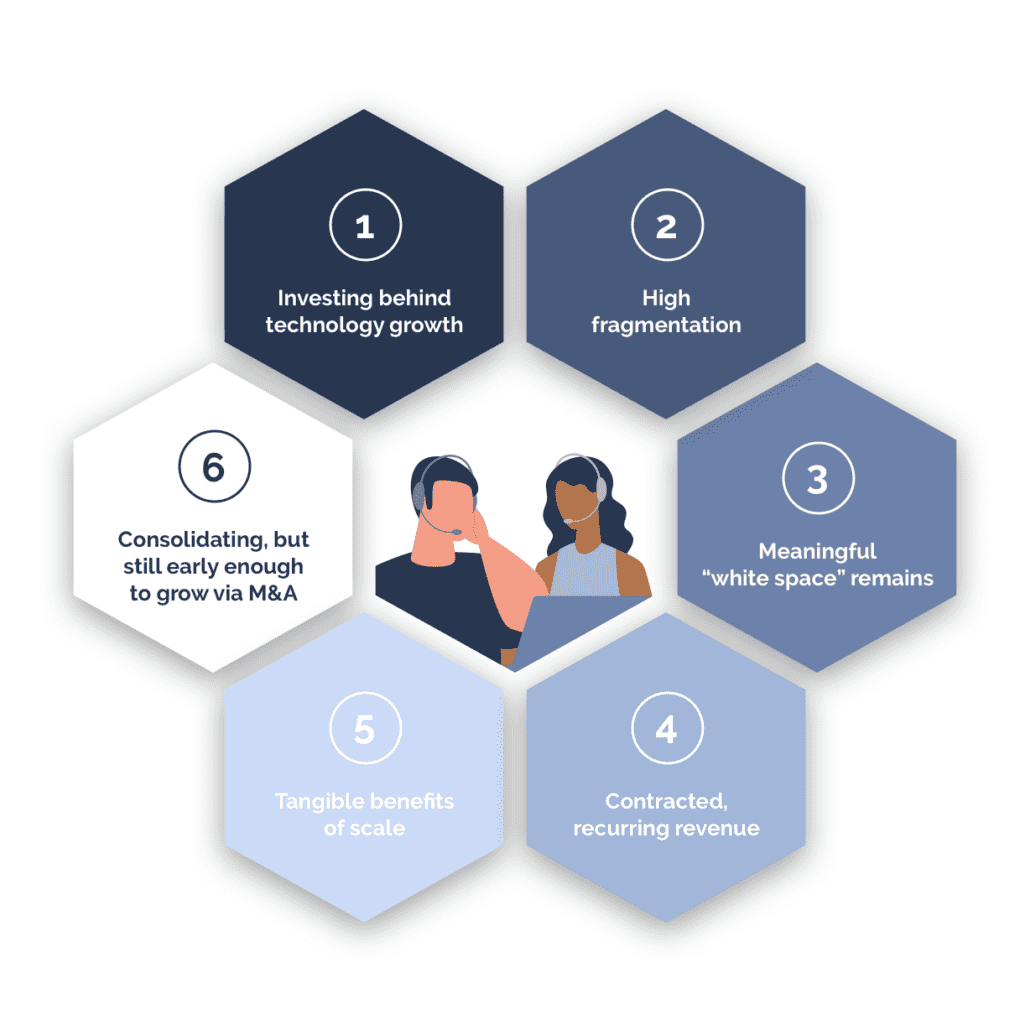

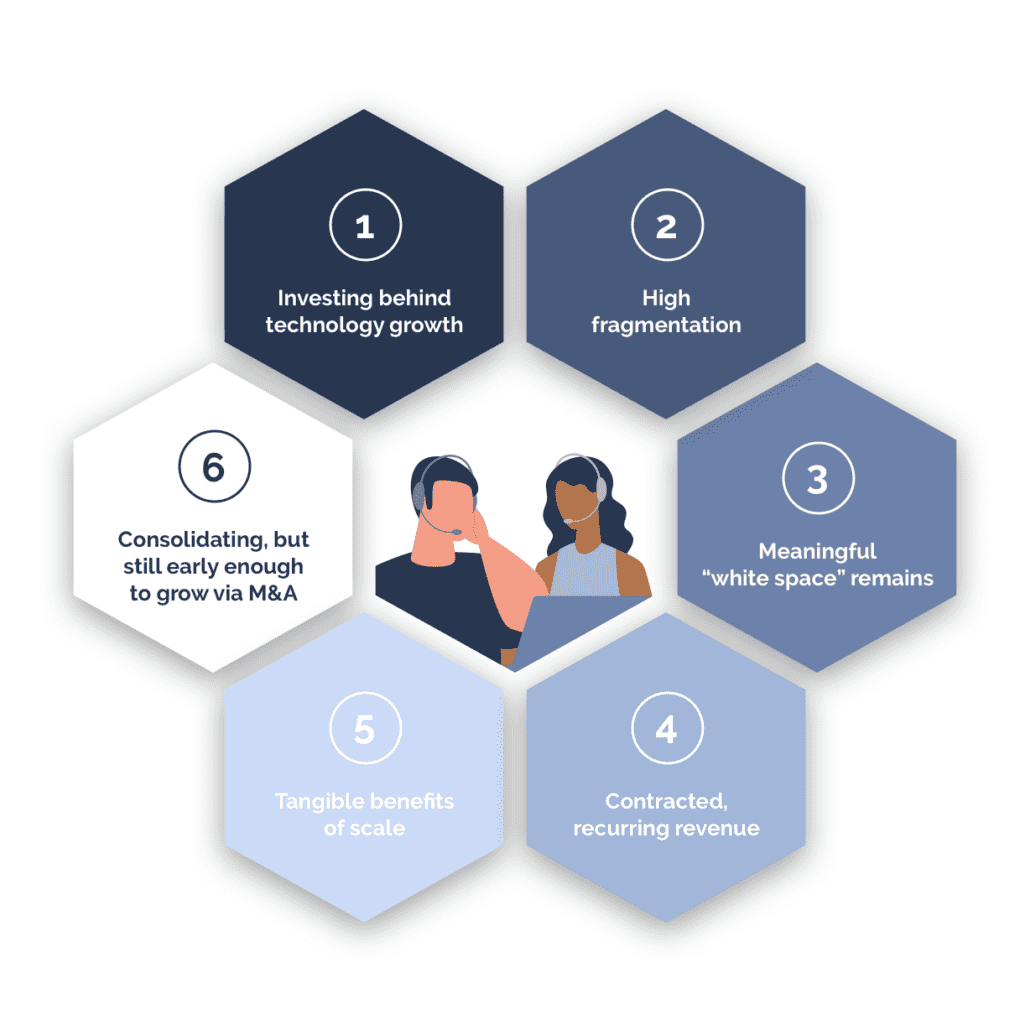

PE funds are smitten with MSPs. One need only look at the large and growing volume of transaction activity in the industry to draw this conclusion. The following graphic and supporting commentary will explain why.

- Investing behind technology growth. Worldwide IT spending is expected to increase 4% annually through 2022, and a great way to invest alongside this growth without taking direct technology risk is to invest in MSPs. This is because MSPs are not necessarily beholden to any specific technology and can nimbly adapt, and help their clients adapt, to inevitable technology change when it occurs. Although the backdrop within the MSP industry is technology, the B2B nature of the service offering is comfortable for non-tech investors and will likely be a gateway for firms with less tech experience to get closer to technology plays.

- High fragmentation. The most credible figure I’ve seen is that there are an estimated 3,700 MSPs in the U.S., the vast majority of which are owned / operated by individuals (i.e. rather than by VC or PE funds). And, in most cases, the basis of competition is largely local or regional with no clear national leader serving SMBs. Therefore, the sheer number of remaining independent MSPs bodes well for the ability to build regional leadership through a focused acquisition strategy.

- Meaningful “white space” remains. Believe it or not, an estimated 30% or so of SMBs have not yet outsourced the management of their IT needs which suggests strong organic growth potential via new client acquisition. Further, MSPs continue to offer a compelling value proposition for SMBs to outsource this service, so it’s likely that any slow adopters of the MSP model will ultimately see the light.

- Contracted, recurring revenue. Contracts are customary in the MSP industry which provides good revenue visibility to investors and management teams alike. Most MSPs will have some mix of recurring managed services revenue, project-based work and re-selling income, but the best MSPs will derive 50% or more of total revenue from MRR.

- Tangible benefits of scale. Investors want to know that there are real benefits to scaling their MSP platforms aside from simply generating more profitability. With MSPs, growth means the ability to better leverage fixed costs (e.g. Network Operations Centers (NOCs), internal software expense), achieve better pricing & mindshare from key product / software vendors, and access more resources to support customer acquisition which can be expensive when targeting SMBs (e.g. Sales force, digital marketing).

- Consolidating, but still early enough to grow via M&A. To borrow a baseball analogy, we’re likely in the 3rd inning of the MSP industry’s consolidation. Despite the fact that there are two dozen or so private equity-backed MSP platforms, many markets have little-to-no representation by consolidators. In other words, secondary or tertiary markets continue to present opportunity for investors.

What a “Good” MSP Looks Like to a Private Equity Investor

With nearly 4,000 MSPs in the U.S. there are going to be good MSPs and not-so-good MSPs. Fortunately, many MSP owners have readily embraced best practices and KPI benchmarking to maximize the valuation of their business. Here are some general guidelines for what a private equity investor is going to look for in an MSP.

|

Explanation |

1. Higher Value-Added Service Offering 1. Higher Value-Added Service Offering |

There’s no faster way to determine how commoditized (or not) an MSP’s service offering is than to look at their Gross Profit Margins. Ideally, you will want to see Gross Profit margins in excess of 30%. Higher margin services include managed services and cybersecurity whereas less value-added services include things like hardware re-selling and routine project-based work. |

2. Strong Recurring Revenue Profile 2. Strong Recurring Revenue Profile |

Across all industries, companies are doggedly chasing MRR in the interest of maximizing the value of their companies. MSPs are no exception – in fact, the most tangible benefit of IT services companies evolving from VARs to MSPs has been their ability to capture more recurring revenue. So, investors are generally going to want to see 40-50% or more of an MSP’s revenue tied to recurring maintenance and monitoring services. |

3. High Client Retention 3. High Client Retention |

One of the benefits of the MSP space is a tendency for service providers to retain clients. I would argue that MSPs doing a satisfactory job or better should not be losing accounts with the exception of those clients that go out of business or get acquired. Therefore, annual client retention should be in excess of 90% for a good MSP. Below that level, and MSPs will need to have a pretty good explanation as to why. |

4. Longer Contract Terms are Better 4. Longer Contract Terms are Better |

For the same reason that investors like recurring revenue, they also like contracts – increased certainty of future revenue and profits. Contracts are customary in the MSP space, so suitors will typically want to see a minimum of 1-year contracts (particularly for any larger accounts) to provide more comfort around stability of an MSP’s clients. |

5. History of (Successful) Acquisitions 5. History of (Successful) Acquisitions |

Insofar as M&A growth is a compelling way to rapidly grow the scale of an MSP, an investor will take comfort in the fact that an MSP has lived through at least one acquisition and integration exercise. Anybody can talk about doing add-on acquisitions, but until you’ve done them, you won’t have the benefit of knowing the pitfalls to watch out for. Interestingly, investors may even like to see that one or more prior deals didn’t go well such that you won’t make the same mistakes again. |

6. Sophisticated Client Acquisition Engine 6. Sophisticated Client Acquisition Engine |

The double-edged sword of high client retention is that it can be hard to unseat the incumbent service provider of a prospective client. Therefore, a material portion of organic growth for an MSP will be the acquisition of clients that may have not previously had a relationship with an MSP. This means that MSPs seeking to ramp up organic growth will have to invest in things like sales personnel, SEO and digital marketing with the attendant processes behind them to produce good outcomes. An MSP with organic growth of less than 5% may not yet have cracked the code on client acquisition. |

7. Client and End Market Diversity 7. Client and End Market Diversity |

Most private equity professionals learn in Investing 101 that customer concentration is bad. And, as a general rule, investors will pause if any customer accounts for 20% or more of total Revenue. The beauty of the MSP space is that many MSPs are serving the SMB community which often translates into a very appealing diversity of accounts with limited dependence on any one or more clients. Similarly, end market exposure can create risks if, say, an MSP is serving a preponderance of clients in a cyclical space that may put a swath of those clients out of business every time a recession hits. So, investors will want to see a healthy mix of industries served and may hesitate around a focus on clients within sectors like Energy or Construction, for example. |

8. History of Adaptation to Technology and Industry Change 8. History of Adaptation to Technology and Industry Change |

One thing is for sure, there will be technological change to which MSPs will have to adapt in the future. A good present example is the migration to the cloud and the implications that’s having on on-premise maintenance and hardware sales. So, a good MSP will have proven able to nimbly react to prior periods of technological disruption and help their clients respond accordingly. After all, the beauty of the MSP industry is that most MSPs are not beholden to any one technology and should be able to successfully adapt during times of change. A negative sign would be if an MSP holds firm to declining service offerings in spite of clear signs that the world is changing. |

In the Land of the MSP, the MSSP is King

Wait, what is that extra “S” doing in there? If you’re like me, it actually took me a while to admit that I wasn’t quite sure how an MSP differed from an MSSP. To eliminate any doubt, an MSSP is essentially an MSP that specializes in providing security-as-a-service offerings for their customers. In other words, MSP + strong cybersecurity capabilities = MSSP, and the acronym stands for Managed Security Service Provider. While MSPs have been around for nearly 20 years, MSSPs have only recently started to emerge as a more sophisticated variant on the traditional MSP model. This is important because there will likely be an ongoing and increasing need for companies to embrace best practices in thwarting the cybervillain community lest they be subjected to ransomware or some other crippling attack on their business. So, the mission critical and esoteric nature of cybersecurity is likely to create a high growth, high margin opportunity for MSSPs for the foreseeable future, and investors will react accordingly by demonstrating strong interest in both acquiring MSSPs and helping their existing MSPs get their extra “S”. The challenge is going to be when MSPs simply start referring to themselves as MSSPs in an effort to elevate their valuations. Investors will need to respond in kind by asking more granular questions about service offerings, creating an interesting cat and mouse game while it unfolds.

Conclusion

We hope this sheds some light on why private equity funds like investing in MSPs and what they’re looking for in an MSP. As always, we’re here to help, so give us a call to start a conversation.

_______

1Yes, I realize that the proper saying would have been, “…swallows of Capistrano,” but I couldn’t help myself3.

2I must admit that one of the things I miss most about having an in-house IT guy at a prior firm were the colorful stories about niches of daily life not often frequented by members of the non-tech community. My all-time favorite involved a lengthy diatribe about the alleged dangers of using ammonia to clean out a ferret cage given the potential to lose consciousness – an unfortunate experience endured by our IT guy on more than one occasion.

3If you somehow don’t know that this is an homage to Dumb and Dumber, then you are likely terribly confused by the reference and should watch the movie immediately to enhance your awareness of an essential film in the canon of American comedy.

4The same article from 1981 also addresses the notion of technology-driven job displacement when one economist is quoted as saying, “What we’ll see is a large displacement of many people as more computers and computerized robots are brought into the workplace.” If this sentiment sounds familiar, it’s because the idea of AI’s potential to eliminate jobs is presently top of mind for workers across most, if not all, sectors.

About ClearLight Partners

ClearLight is a private equity firm headquartered in Southern California that invests in established, profitable middle-market companies in a range of industry sectors. Investment candidates are typically generating between $4-15 million of EBITDA (or, Operating Profit) and are operating in industries with strong growth prospects. Since inception, ClearLight has raised $900 million in capital across three funds from a single limited partner. The ClearLight team has extensive operating and financial experience and a history of successfully partnering with owners and management teams to drive growth and create value. For more information, visit www.clearlightpartners.com.

Disclaimer: The views and opinions expressed in this blog are solely my own and do not necessarily reflect any ClearLight opinion, position, or policy.

1. Higher Value-Added Service Offering

1. Higher Value-Added Service Offering 2. Strong Recurring Revenue Profile

2. Strong Recurring Revenue Profile 3. High Client Retention

3. High Client Retention 4. Longer Contract Terms are Better

4. Longer Contract Terms are Better 5. History of (Successful) Acquisitions

5. History of (Successful) Acquisitions 6. Sophisticated Client Acquisition Engine

6. Sophisticated Client Acquisition Engine 7. Client and End Market Diversity

7. Client and End Market Diversity 8. History of Adaptation to Technology and Industry Change

8. History of Adaptation to Technology and Industry Change