Don’t Stay Past Midnight – Reflections on Knowing When to Sell Your Business (Part 4)

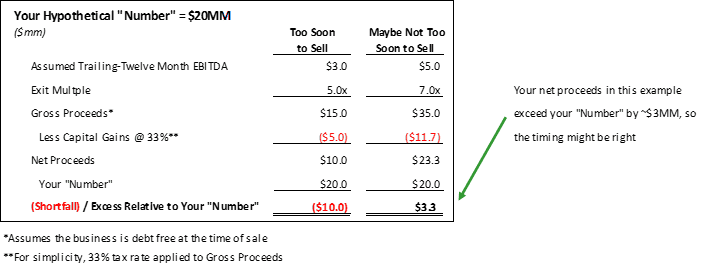

If you’ve been with us for one or more of the prior weeks, you know that we’ve been walking through a list of six ways to objectively determine if it might be a good time to consider the sale of your private business. Last week’s blog touched on the exercise of comparing the expected after-tax proceeds from a sale to your “Number” (i.e. the amount you need to achieve from a sale to meet your vision for life post transaction). In summary, if a sale allows you to clear your pre-defined goal, then you may have yet another objective input to your decision to consider an exit.

This week, we’re going to explore #4 below which takes the analysis up a level and examines the state of the industry in which you’re operating:

- Valuations are Historically High

- You’ve Experienced Multi-Year Growth in Revenue and Profits

- Expected Proceeds from an Exit Exceed Your Previously Defined Goals (i.e. You’ll Hit Your “Number”)

- The Industry is Experiencing Tailwinds from Positive Trends

- Value Remains for the Next Buyer

- You See Your Competitors Deciding to Sell

If there’s one thing we’ve learned from investing in private companies for nearly 20 years, it’s that getting the industry right is a powerful force in driving good investment outcomes. Not to oversimplify things, but Good Industry + Good CEO has proven to be more than half the battle in most cases. So, we pay close attention to the industry in which a company is operating if we are considering making an investment. Here are some more detailed reflections on how to think about the state of your industry:

- The Industry is Experiencing Tailwinds from Positive Trends. As a private equity investor we like growth, but we don’t necessarily look for rapid growth in an industry to compel the pursuit of a deal. In fact, if we see graphs with industry growth rates that are too steep, we may often conclude that the sector is better suited for a VC investor who has the stomach for the valuations that accompany such growth.

- In general, we want to invest in companies whose industry growth is comfortably beating GDP for tangible reasons, and we’ve historically pursued businesses operating in sectors with 5-15% expected annual growth for the foreseeable future. Ideally, this growth is being propelled by factors that are easy to understand, concrete and sustainable. Said another way, if you can explain why your industry is growing to a family member with no prior familiarity of it, then that is a good starting point. Further, all industries go through cycles, so if you are currently on an upswing and can explain in simple terms why favorable trends are likely to persist, then this should resonate with investors.

- Here’s a simple example to illustrate how an investor might evaluate the relative attractiveness of your business based on the growth of the industry in which you’re operating:

Stay tuned for the next blog where we’re going to address point #5 above, Value Remains for the Next Buyer. As always, we’re interested in your feedback. To start a conversation, please reach out to Joe Schmidt (jjs@clearlightpartners.com) or Mark Gartner (mpg@clearlightpartners.com).

_______

About ClearLight Partners

ClearLight is a private equity firm headquartered in Southern California that invests in established, profitable middle-market companies in a range of industry sectors. Investment candidates are typically generating between $4-15 million of EBITDA (or, Operating Profit) and are operating in industries with strong growth prospects. Since inception, ClearLight has raised $900 million in capital across three funds from a single limited partner. The ClearLight team has extensive operating and financial experience and a history of successfully partnering with owners and management teams to drive growth and create value. For more information, visit www.clearlightpartners.com.

Disclaimer: The views and opinions expressed in this blog are solely my own and do not necessarily reflect any ClearLight opinion, position, or policy.