Don’t Stay Past Midnight – Reflections on Knowing When to Sell Your Business (Part 3)

Welcome back to our blog series that tells you, a business owner, how we, a private equity fund, determine the proper timing to consider an exit. Having been investing in private companies for nearly 20 years, this is a question with which we have had to contend many times. As a result, we respect that it can be challenging and stressful, but if you strip away the emotion surrounding the exercise, you’re left with common sense indicators that can help you make an objective decision about when to sell. These indicators are presented in the list below.

We’ve previously explored points #1 and #2. This week, you guessed it, we’re going to touch on point #3 in more detail:

- Valuations are Historically High

- You’ve Experienced Multi-Year Growth in Revenue and Profits

- Expected Proceeds from an Exit Exceed Your Previously Defined Goals (i.e. You’ll Hit Your “Number”)

- The Industry is Experiencing Tailwinds from Positive Trends

- Value Remains for the Next Buyer

- You See Your Competitors Deciding to Sell

We could have also probably titled this one, “Pigs Get Fat, Hogs Get Slaughtered” but decided to go with a softer delivery. Take a look at how we think about this point:

- Expected Proceeds from an Exit Exceed Your Previously Defined Goals. Most professional investors have a pre-defined notion of what “good” looks like from a returns perspective. Classically, in the private equity business a good outcome is doubling or tripling your money in around 5 years. Private equity funds might also describe success in terms of IRR %. Therefore, when considering an exit, if a private equity firm has reason to believe that a sale will generate returns that exceed its pre-defined thresholds, then this becomes a fairly black and white input that helps inform the exit decision. The benefit of defining these metrics ahead of time is that it wards off the judgement clouding effects of fear, irrational optimism, and/or whatever your gut is telling you that day.

-

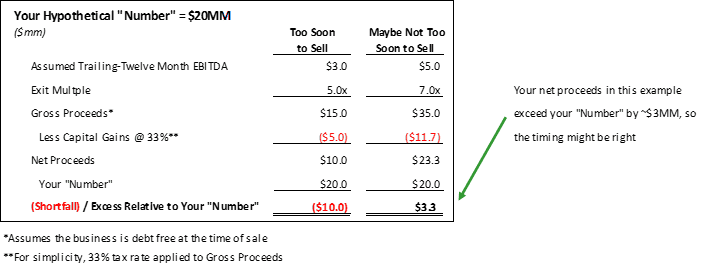

However, returns metrics are likely not how you as a business owner are looking at the world. We’ve found that many entrepreneurs have a round number (after tax) in mind that they want to hit in order to have a post-transaction existence that fulfills their visions for the next phase of life. This number might contemplate future travel, real estate purchases, boats, starting a new business and/or allocation of the sale proceeds to family members. So, using the information available to you regarding valuation multiples, you should have a pretty good idea of whether a sale will allow you to hit your number. If it does, then considering an exit might be a good idea.

- Here’s a simple example to drive home the point:

Stay tuned for next week’s blog where we’re going to address point #4 above, The Industry is Experiencing Tailwinds from Positive Trends. As always, we’re interested in your feedback. To start a conversation, please reach out to Joe Schmidt (jjs@clearlightpartners.com) or Mark Gartner (mpg@clearlightpartners.com).

_______

About ClearLight Partners

ClearLight is a private equity firm headquartered in Southern California that invests in established, profitable middle-market companies in a range of industry sectors. Investment candidates are typically generating between $4-15 million of EBITDA (or, Operating Profit) and are operating in industries with strong growth prospects. Since inception, ClearLight has raised $900 million in capital across three funds from a single limited partner. The ClearLight team has extensive operating and financial experience and a history of successfully partnering with owners and management teams to drive growth and create value. For more information, visit www.clearlightpartners.com.

Disclaimer: The views and opinions expressed in this blog are solely my own and do not necessarily reflect any ClearLight opinion, position, or policy.