Don’t Stay Past Midnight – Reflections on Knowing When to Sell Your Business (Part 6)

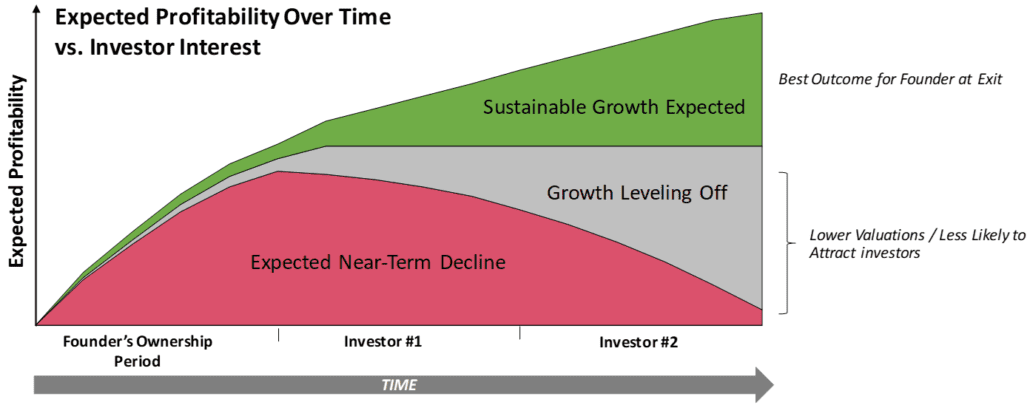

If you’ve been with us for the preceding weeks, you know that we’ve been walking through a list of six ways to objectively determine if it might be a good time to consider the sale of your private business. Last week’s blog addressed the concept of making sure there is enough future value remaining in the business to attract investors. In short, if you wouldn’t invest in your company today, then why would someone else?

This week, we’re going to explore the 6th and final point below which suggests that if your competitors are deciding to sell, then they have likely thoughtfully considered one or more of the items on our list and concluded that the timing was right.

- Valuations are Historically High

- You’ve Experienced Multi-Year Growth in Revenue and Profits

- Expected Proceeds from an Exit Exceed Your Previously Defined Goals (i.e. You’ll Hit Your “Number”)

- The Industry is Experiencing Tailwinds from Positive Trends

- Value Remains for the Next Buyer

- You See Your Competitors Deciding to Sell

Remember when your mom said, “If your friends jumped off of a cliff, then would you do it too?” Well, maybe you would if the cliff was a metaphor for selling your business and valuations in your industry were historically high, you’d experienced consistent growth in Revenue and Profits, a sale would allow you to live in a manner consistent with your goals, your industry was benefitting from an upswing, and the business would make for a good investment by an investor’s standards. Here are some more reflections on the topic:

- You See Your Competitors Deciding to Sell. If you assume that (i) an entrepreneur’s business is their most valuable financial asset and (ii) that they are not likely to part ways with it unless one or more compelling factors drove them to the conclusion to sell, then news of a competitor deciding to exit should result in some real introspection on your own exit timing. And, an ancillary benefit of a competitor proceeding with a transaction is that you can often triangulate around the purchase multiple once the gossip mill starts humming about the deal. It goes without saying that just because your peers in the industry decide to sell, it doesn’t mean that you have to. Perhaps you have a higher risk tolerance than they do and your patience will pay off. Just recognize that forces could be at work that are creating a good window for an exit.

Well, this completes our blog series, and we hope you’ve benefitted from some of these perspectives. As always, we’re interested in your feedback. To start a conversation, please reach out to Joe Schmidt (jjs@clearlightpartners.com) or Mark Gartner (mpg@clearlightpartners.com). We want to hear from you!

_______

About ClearLight Partners

ClearLight is a private equity firm headquartered in Southern California that invests in established, profitable middle-market companies in a range of industry sectors. Investment candidates are typically generating between $4-15 million of EBITDA (or, Operating Profit) and are operating in industries with strong growth prospects. Since inception, ClearLight has raised $900 million in capital across three funds from a single limited partner. The ClearLight team has extensive operating and financial experience and a history of successfully partnering with owners and management teams to drive growth and create value. For more information, visit www.clearlightpartners.com.

Disclaimer: The views and opinions expressed in this blog are solely my own and do not necessarily reflect any ClearLight opinion, position, or policy.