Don’t Stay Past Midnight – Reflections on Knowing When to Sell Your Business (Part 5)

If you’ve been with us for one of the preceding weeks, you know that we’ve been walking through a list of six ways to objectively determine if it might be a good time to consider the sale of your private business. Our prior blog highlighted why investors respond well to an industry that is benefitting from positive trends that are likely to continue for the foreseeable future. In short, good industries often support good investments, and if your business is operating in a sector with tailwinds at its back, this could be another factor contributing to a decision to explore an exit.

This week, we’re going to explore #5 below which is a good reminder that in order to drive a good exit, buyers have to believe that your business has strong growth prospects for the foreseeable future. This is important because whoever buys your business has to also believe that they will be able to sell the growth story to another investor down the road.

- Valuations are Historically High

- You’ve Experienced Multi-Year Growth in Revenue and Profits

- Expected Proceeds from an Exit Exceed Your Previously Defined Goals (i.e. You’ll Hit Your “Number”)

- The Industry is Experiencing Tailwinds from Positive Trends

- Value Remains for the Next Buyer

- You See Your Competitors Deciding to Sell

Think of it this way, nobody would purchase a lemon with all of the juice squeezed out of it, right? Perhaps a lemon is not the best example here, but you get the point. Here are some more reflections on the topic:

- Value Remains for the Next Buyer. Sometimes, an owner’s decision to exit is driven by the threat of looming headwinds to the business or industry. Conceptually, getting out before these challenges arrive makes sense, but it’s likely that investors are already, or will be, attuned to those same issues, and it may then be too late to drive an optimal outcome from a sale. At a minimum, investors are going to need to know that the prospects for growth will remain strong for the next 5-10 years. Otherwise, they may encounter challenges when they ultimately seek an exit. Said another way, if you are considering an exit, reflect on whether you would want to invest in your business today.

-

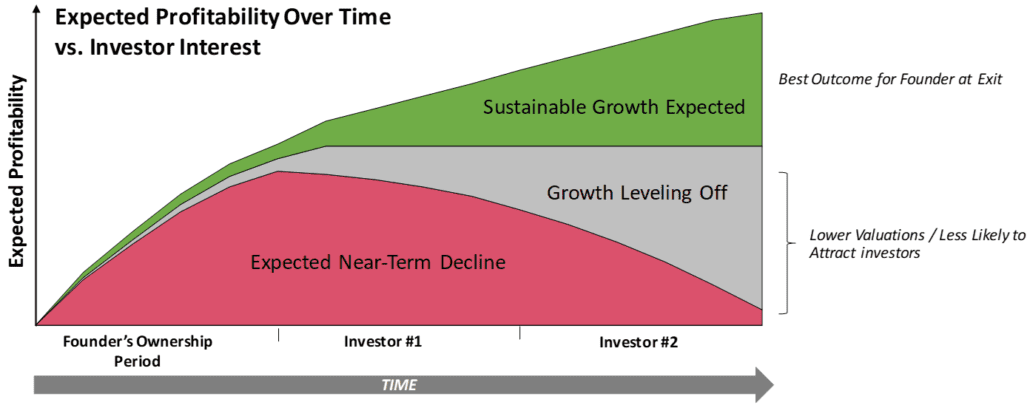

To drive home the point visually, take a look at the following chart that illustrates how an investor may assess the relative attractiveness of your business based on the expected growth in profitability over time. The punchline is that your prospects for an exit are substantially improved if investors see a sustainably bright future for the company.

Stay tuned for our final blog where we’re going to address point #6 above, You See Your Competitors Deciding to Sell. As always, we’re interested in your feedback. To start a conversation, please reach out to Joe Schmidt (jjs@clearlightpartners.com) or Mark Gartner (mpg@clearlightpartners.com).

_______

About ClearLight Partners

ClearLight is a private equity firm headquartered in Southern California that invests in established, profitable middle-market companies in a range of industry sectors. Investment candidates are typically generating between $4-15 million of EBITDA (or, Operating Profit) and are operating in industries with strong growth prospects. Since inception, ClearLight has raised $900 million in capital across three funds from a single limited partner. The ClearLight team has extensive operating and financial experience and a history of successfully partnering with owners and management teams to drive growth and create value. For more information, visit www.clearlightpartners.com.

Disclaimer: The views and opinions expressed in this blog are solely my own and do not necessarily reflect any ClearLight opinion, position, or policy.