Back to School: The Current Opportunity to Invest in Private Preschools

Read time: 3-4 minutes

“The child is both a hope and a promise for mankind.” (Maria Montessori)

Introduction

The basic definition of a “do well by doing good” industry is one where you can achieve financial success as a result of owning or operating a business that benefits society. Perhaps the most readily acknowledged sector that embodies this concept is education. For decades now, investors have flocked to for-profit educational products and services, and in many cases strong returns have ensued alongside the enrichment of students of all ages.

Presently, a growing recognition of the benefits of early childhood education (ECE) is stimulating entrepreneurship and investment alike in facilities focused on serving children up to around eight years of age. To start, children who attend preschool are more likely to have eventually attended and completed college. Further, preschool educated children are less likely to be arrested, more likely to graduate high school and less likely to struggle with substance abuse as adults. For these reasons and others, the evidence overwhelmingly points to the conclusion that preschool is a good idea, and parents are voting with their dollars. Another powerful driver of the industry’s growth has been the increased labor force participation rate of women which now sits at around 58% of the female population. This trend has elevated both the need for childcare as well as disposable incomes. Today, the U.S. ECE industry is around $28 billion and growing at a rate of 5% annually.

The Different Types of Private Preschools

In this context, preschool generally refers to childcare centers with an educational focus. Preschools are typically more expensive than traditional daycare and charge tuition that is paid directly by families (i.e. not subsidized). When referring to the different types of preschools, more often than not, you’ll identify them by their pedagogy. If you weren’t previously familiar with the term pedagogy, it stems from Greek word paidagōgia which essentially means “to lead a child”, and the dictionary1 defines pedagogy as follows:

- Pedagogy (pe-dә-gō-jē): The art or science of teaching; education, instructional methods.

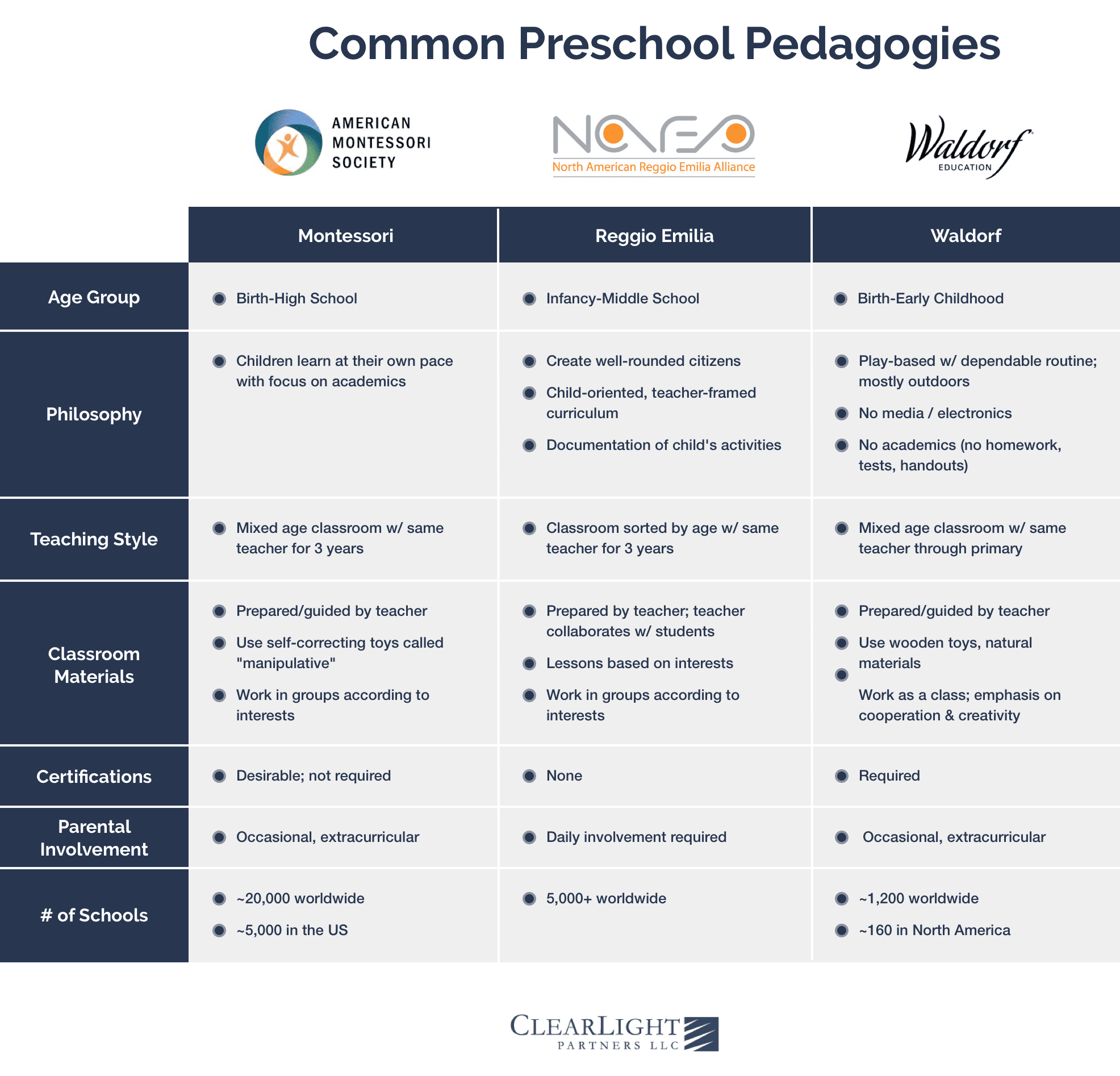

The preeminent pedagogies include Montessori, Reggio Emilia, Waldorf and other / unaffiliated. In terms of the number of schools, Montessori has emerged as the leading branded pedagogy by a fairly wide margin. The following section provides a brief history of how Montessori schools came about followed by a high-level comparison to Reggio Emilia and Waldorf in the accompanying chart.

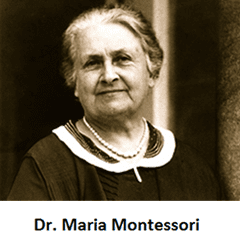

The Montessori educational philosophy was developed by Dr. Maria Montessori, an Italian physician and educator. The first Montessori center was opened in 1907 in an apartment building in Rome and enrolled 50 or so children of low-income working parents between the ages of two and seven. Through observation, Dr. Montessori took note of incidence of deep concentration, repetition of activity and a sensitivity to the order of the environment. It was in this first classroom that Dr. Montessori discovered that when given autonomous choice of activity, the children demonstrated more interest in practical activities and educational materials than in the toys provided for them. She concluded that a self-directed environment would allow the students to develop better self-sufficiency and reach higher levels of understanding. Indeed, four- and five-year olds educated through her methods quickly gained a proficiency in writing and reading far beyond what was expected for their age. These early observations led to the formalization and implementation of practices that became the cornerstones of the Montessori pedagogy. By 1911, the first Montessori schools were opened in the U.S., and by 1916 there were more than 100 schools in operation. The Montessori method later experienced some setbacks in the 1920’s based on criticism from William Heard Kilpatrick, a highly regarded educational figure, with nearly every school shuttering as a result. However, the Montessori pedagogy experienced a resurgence in the 1950’s, and today there approximately 5,000 Montessori schools operating in the U.S.

The Montessori educational philosophy was developed by Dr. Maria Montessori, an Italian physician and educator. The first Montessori center was opened in 1907 in an apartment building in Rome and enrolled 50 or so children of low-income working parents between the ages of two and seven. Through observation, Dr. Montessori took note of incidence of deep concentration, repetition of activity and a sensitivity to the order of the environment. It was in this first classroom that Dr. Montessori discovered that when given autonomous choice of activity, the children demonstrated more interest in practical activities and educational materials than in the toys provided for them. She concluded that a self-directed environment would allow the students to develop better self-sufficiency and reach higher levels of understanding. Indeed, four- and five-year olds educated through her methods quickly gained a proficiency in writing and reading far beyond what was expected for their age. These early observations led to the formalization and implementation of practices that became the cornerstones of the Montessori pedagogy. By 1911, the first Montessori schools were opened in the U.S., and by 1916 there were more than 100 schools in operation. The Montessori method later experienced some setbacks in the 1920’s based on criticism from William Heard Kilpatrick, a highly regarded educational figure, with nearly every school shuttering as a result. However, the Montessori pedagogy experienced a resurgence in the 1950’s, and today there approximately 5,000 Montessori schools operating in the U.S.

The Thesis for Investing in Private Preschools

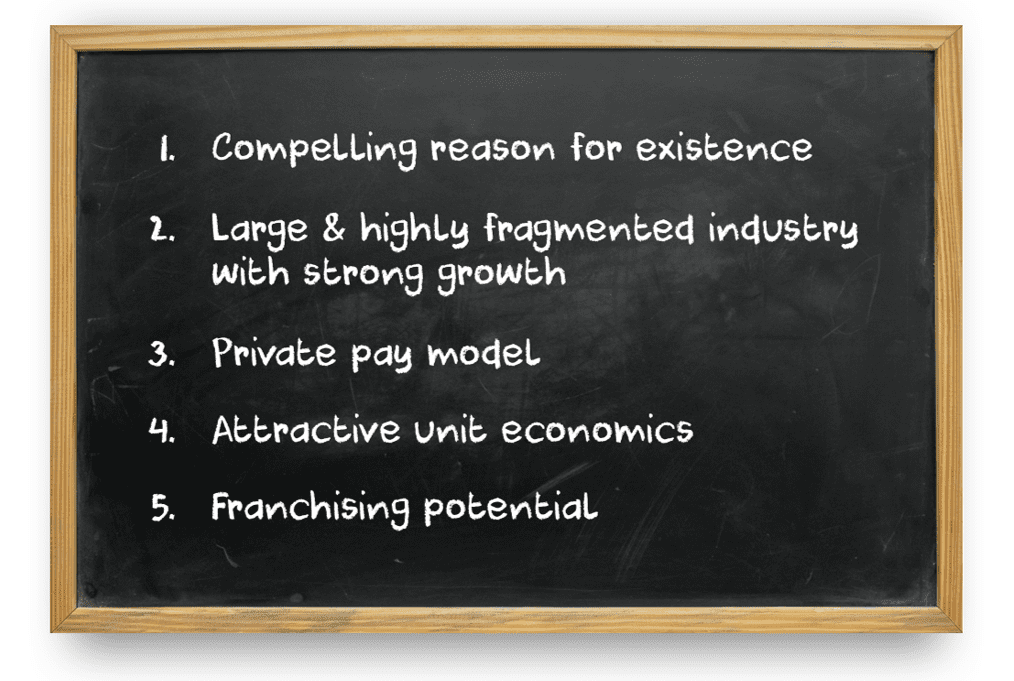

When strong industry growth, fragmentation and elevated profit margins collide, it tends to create a fertile environment for private equity investing activity. The following graphic and supporting commentary will provide some more color on why private preschools present a compelling investment thesis.

- Compelling reason for existence. As one of the classic “do well by doing good sectors”, early childhood education benefits from both strong social and commercial tailwinds. Further, numerous studies point to lasting benefits of preschool that extend into adulthood. Early childhood education is just one of those sectors that’s hard to argue about – it seems to only offer positives.

- Large & highly fragmented industry with strong growth. As mentioned previously, the U.S. early childhood education industry is around $28 billion and growing around 5% annually. The industry is comprised of over 20,000 preschools with the largest direct competitor having an approximate 2% market share. So, given the fairly extreme fragmentation without the presence of nationally dominant competition, there exists an exciting opportunity to build strong local / regional / superregional preschool footprints.

- Private pay model. The variety of preschools contemplated here are private pay models that do not rely on government subsidy. This means that tuition is paid directly by families, and preschool operators will thus not be exposed to any political forces that could adversely affect revenue generated through government programs. Think of it this way, as an investor or owner of a private preschool, it would make for a less stressful existence not having to worry about uncertainties created during election years, and your school’s valuation will be better than one that has exposure to subsidies.

- Attractive unit economics. Generally speaking, a well-managed mature school can generate $2-3MM of annual revenue with 20-30% EBITDA margins. If you assume a build-out cost of $500k-1MM, then there is good rationale to grow via a greenfield, or de novo, strategy.

- Franchising potential. If you investigate some of the larger private preschool operators in the U.S., you will come to find that many of them have sold franchises to independent business owners. Franchising can be an excellent way to rapidly scale a school’s footprint by allowing entrepreneurs to invest the capital to own and operate their own schools. In our case, we’ve invested extensively in franchising, so this dynamic creates a merging of two arenas on which we are presently focused – private preschools and franchisors.

What Investors Want to See in a Private Preschool

With over 20,000 preschools across the U.S. there’s a wide spectrum of operating models and resulting performance. From an investor’s perspective, the following KPIs and benchmarks are generally indicative of a well-managed preschool.

| Explanation | |

|---|---|

1. Sufficient Child Capacity to Support Critical Mass 1. Sufficient Child Capacity to Support Critical Mass |

There are exceptions to every rule, but we generally look for capacity of around 150+ students. Using basic assumptions around tuition, this allows for a critical mass of revenue and profitability on a per school basis. |

2. Utilization Indicative of Parent / Community Satisfaction 2. Utilization Indicative of Parent / Community Satisfaction |

High utilization is generally indicative of parent satisfaction with a school, but you don’t always need to see that a school is 100% utilized. While full utilization is encouraging, it doesn’t provide for the best student experience or organic growth outside of tuition increases, so investors will generally look for utilization of around 85%+. |

3. Reasonable Operating Tenure 3. Reasonable Operating Tenure |

There’s something to be said for longevity. If a school has made it past the 3-year mark, it’s generally operating under a viable model. Investors may have some hesitation around schools that have not yet withstood the test of time. |

4. Relevant Accreditation 4. Relevant Accreditation |

NAEYC accreditation is a great stamp of approval for a private preschool operator. It shows that they not only took the initiative to make sure their school met important threshold performance and curriculum standards, but that they also passed. Investors may also take comfort with certain pedagogy-specific accreditations (e.g. American Montessori Society, Association of Waldorf Schools). |

5. Strong Reputation; Proven Results 5. Strong Reputation; Proven Results |

Schools with positive online reputations show that they both are paying attention to how their brand is regarded and that they have been validated by parents. Good sites for preschool ratings include GreatSchools.org and Yelp. Assuming a sufficient number of reviews to be statistically significant, it’s hard to see how an investor would get excited about a school with below a 4-star rating. |

6. EBITDA Margins in Excess of 20% for Mature Schools 6. EBITDA Margins in Excess of 20% for Mature Schools |

Tuition for private preschool has reached a level that should create for healthy profit margins for school operators. Many families are now paying upwards of $10,000 / year (or more) per child to attend preschool. Investors will generally want to see 20-30% EBITDA margins for well-managed schools. |

7. Multi-Site Presence 7. Multi-Site Presence |

For a private preschool operator to be considered a “platform” for an investor, they will need to have proven their ability to replicate results across a portfolio of schools. Using general estimates about profitability on a school-level basis, many investors will want to see around 5 or so schools to provide for both a sufficient base of profitability and conviction that the management team has the capability to expand the company’s footprint by opening and/or acquiring new schools. Given the fragmentation of this industry, and the propensity for owners to operate 1-2 locations, larger operators can be harder to come by. |

8. No Headline Issues 8. No Headline Issues |

There is nothing scarier to a parent than the threat of something bad happening to their children. So, prior incidents at a school are going to make investors extremely cautious. Depending on the severity of the issue, an incident at a school could have an extremely damaging effect on a school’s ability to survive and thrive in a local community. |

Conclusion

We hope this illustrates why investors are taking interest in private preschools and some of the attributes they will look for in a school operator. As always, we’re here to help, so give us a call to start a conversation.

_______

1Per dictionary.com

About ClearLight Partners

ClearLight is a private equity firm headquartered in Southern California that invests in established, profitable middle-market companies in a range of industry sectors. Investment candidates are typically generating between $4-15 million of EBITDA (or, Operating Profit) and are operating in industries with strong growth prospects. Since inception, ClearLight has raised $900 million in capital across three funds from a single limited partner. The ClearLight team has extensive operating and financial experience and a history of successfully partnering with owners and management teams to drive growth and create value. For more information, visit www.clearlightpartners.com.

Disclaimer: The views and opinions expressed in this blog are solely my own and do not necessarily reflect any ClearLight opinion, position, or policy.